Unlocking the Future of Energy

How Workforce Shifts, Layoffs, and Talent Shortages Are Reshaping the Sector in 2025

If you’re reading the latest industry headlines, you might be lulled into thinking the energy services sector is just fine… steady as she goes, jobs holding firm, hiring “measured,” and companies “focused on efficiency.”

The numbers seem to back this up:

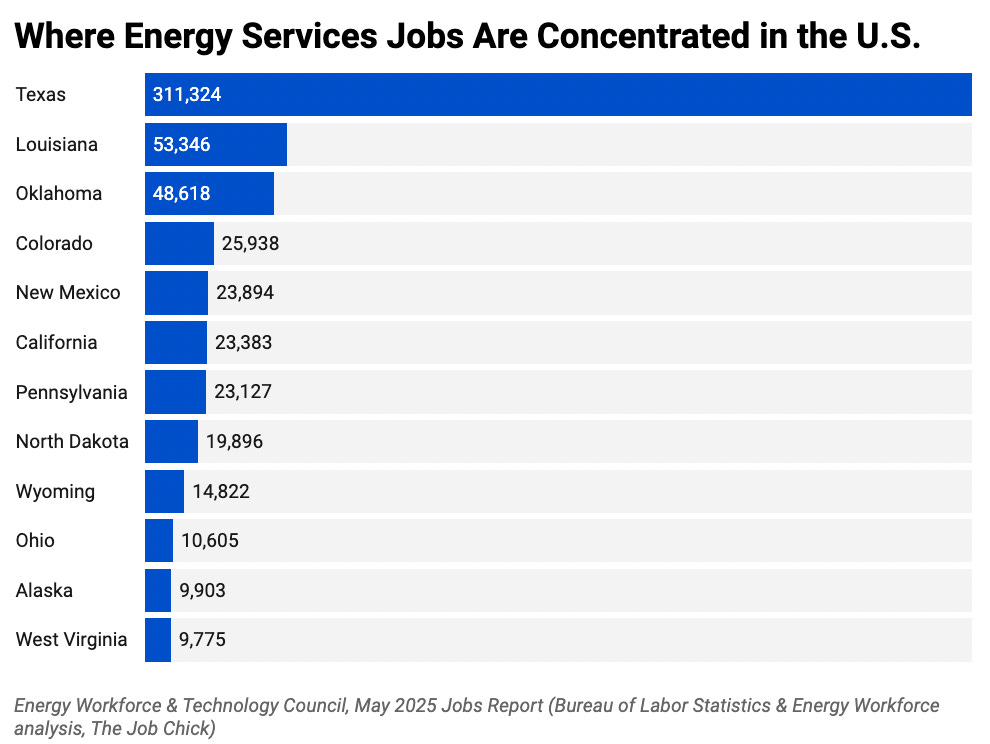

638,876 energy services jobs in May 2025, down just 1,391 from April, with Texas accounting for nearly half the sector’s workforce.

But anyone who’s actually inside the boardroom or on the rig knows that this so-called stability is a curated illusion. The narrative is seriously impressive. The real story is far more volatile, and it’s playing out in ways that most executives are only just starting to acknowledge.

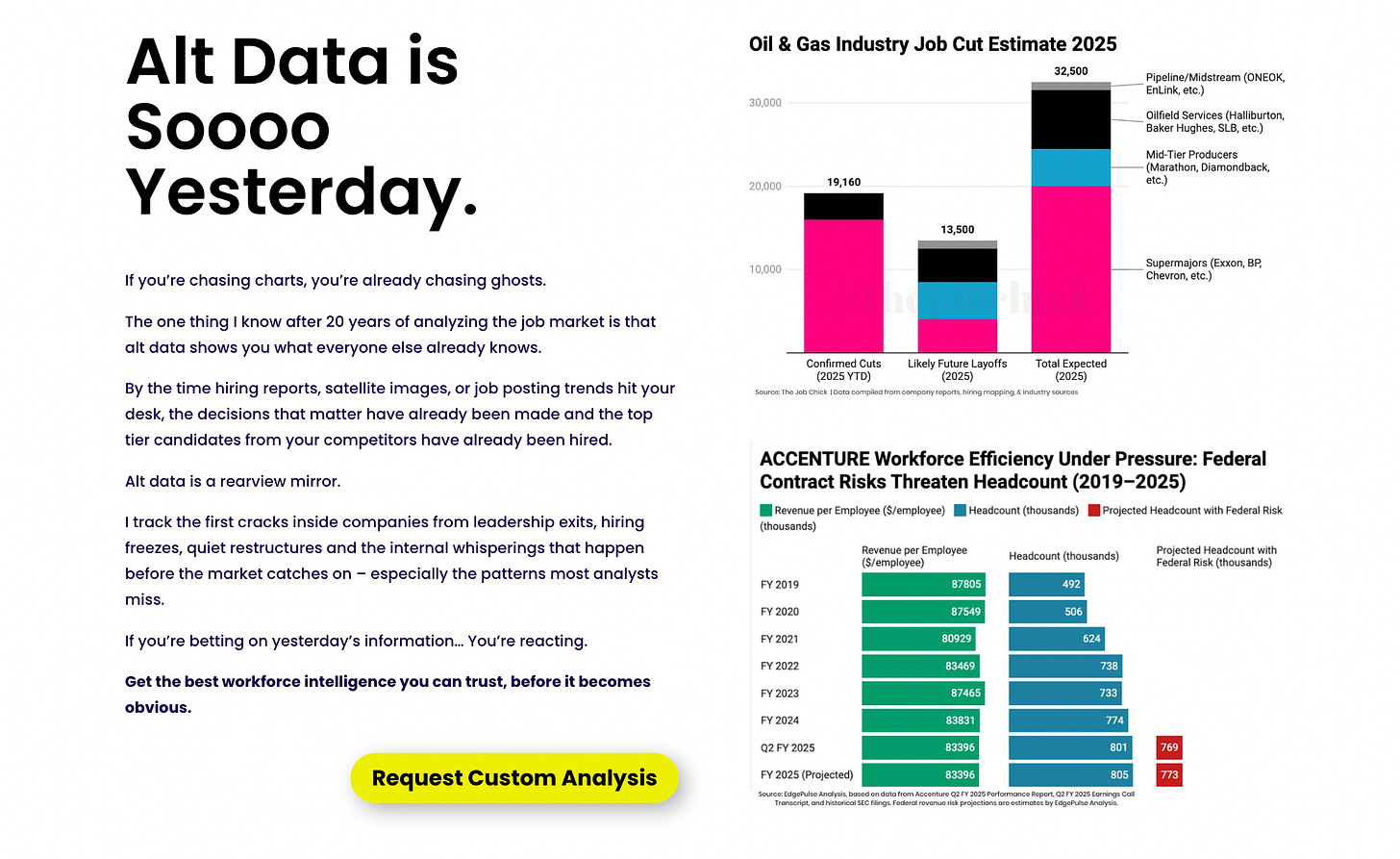

Let’s start with the layoffs. The big names make the news, but the real pain is much more widespread, and much more damaging than the headlines suggest.

Chevron: 8,000 positions eliminated in 2025, primarily in legacy oilfield services. These aren’t just back-office roles; they’re experienced field personnel, engineers, and mid-level managers who know how to keep operations running smoothly.

BP: 4,700 jobs cut, with a focus on mid-level management and support roles. This is part of a broader trend of flattening organizational structures and pushing decision-making closer to the front lines.

Federal Agencies:

Department of Energy: Between 1,200 and 2,000 positions eliminated; more than 2,700 employees applied for voluntary resignation programs, potentially reducing headcount by up to 17%. This is a massive brain drain for an agency that’s supposed to be leading the energy transition.

National Renewable Energy Laboratory (NREL): 114 people let go, citing “complex financial and operational landscapes.” These are scientists and engineers working on the cutting edge of renewable tech.

Bonneville Power Administration: 130 jobs lost outright, another 300 through buyouts and early retirements, nearly 20% of its workforce. This is critical expertise walking out the door.

Smaller service providers and contractors are quietly trimming staff as well, often without fanfare or press releases. Many of these companies are family-owned or regional players who can’t afford to carry excess headcount in a volatile market.

The cumulative impact of these layoffs isn’t just about cost-cutting… it’s about losing the institutional knowledge and expertise that keeps the sector running. These are the people who know how to troubleshoot a drilling rig at 3 a.m., who understand the quirks of a particular field, or who have built relationships with local regulators and communities. No algorithm or AI tool can replace that, at least, not yet.

Meanwhile, the talent shortage is reaching crisis levels. Try to hire a CDL driver, a field technician, or a skilled engineer right now. The wait times are pretty darn brutal, salaries for some roles are up 18% year-over-year, and the best talent is getting offers from tech, manufacturing, and even defense.

Energy professionals received an average of 6.08 external job offers in 2025, up from 5.71 in 2023. That’s six offers per person, and nearly 40% of those are coming from outside the sector.

Tech, infrastructure, defense, and even startups are poaching top talent. They’re offering better pay, better hours, and a sense of purpose that the energy sector is struggling to match.

Companies are still hiring for “10 years of drilling experience” while the world is moving toward AI, data analytics, and renewables. This is a classic case of fighting the last war.

Gen Z and younger workers aren’t lining up to work in the oilfield. They see it as dirty, outdated, and not exactly ESG-friendly. The sector’s reputation is its own worst enemy, and the brain drain is accelerating as top performers leave for industries that offer more than just a paycheck.

The skills gap is widening. Legacy skills are becoming obsolete faster than ever, and the sector is falling further behind in the race for talent. A recent survey found that 68% of energy executives admit their companies lack a clear workforce strategy for the energy transition.

Automation is eating jobs, too.

Drilling rigs now operate with 30% fewer workers than in 2020. AI-driven predictive maintenance and digital twins are replacing field roles.

Companies are quietly offboarding low performers and restructuring teams to avoid bad PR.

The expertise exodus isn’t just about cutting costs, it’s about losing the very people who know how to keep the lights on.

The energy transition isn’t coming. It’s already here. But no one’s really ready for it.

Renewable infrastructure jobs grew 12% in 2025, but only 3% of oilfield workers have cross-trained for these roles. This is a massive mismatch that’s only going to get worse as the transition accelerates.

Companies are saying they’re “pivoting to renewables” while quietly doubling down on fossil projects. Workers are stuck in limbo, unsure of where to invest their time and energy.

A roustabout can’t become a wind turbine tech overnight. Reskilling programs are underfunded, poorly designed, and often disconnected from real-world needs.

Policy whiplash is making things worse. Subsidies for hydrogen hubs and carbon capture are here today, gone tomorrow. Companies won’t invest in training without regulatory certainty.

The skills mismatch is widening, and the sector is falling further behind in the race for talent. This isn’t just a problem for individual companies, it’s a systemic risk for the entire industry.

But it’s not all doom and gloom. The real players aren’t waiting for the market to tell them what to do. They’re making bold moves now, and they’re rewriting the rules of the game.

ExxonMobil quietly hired 500 data scientists from Silicon Valley to build AI-driven drilling models and optimize operations. This isn’t just about cutting costs, it’s about building a new kind of workforce that can thrive in the digital age.

NextEra Energy partnered with community colleges to create a “green trades” pipeline, guaranteeing jobs for graduates and building a new talent pool from the ground up. This is a model that other companies are starting to emulate.

Halliburton dropped entry-level job requirements, hiring ex-military and automotive workers with zero oilfield experience but strong leadership and adaptability. This is a recognition that skills, not pedigree, are what matter most in a rapidly changing industry.

Skills are trumping pedigree. Companies are ditching degrees for competency-based hiring and focusing on real-world experience and adaptability. This is a fundamental shift in how the sector thinks about talent.

Flexibility is the new currency. Winners offer hybrid roles (e.g., three weeks on-site, one week remote), accelerated promotion tracks, and clear pathways for advancement. They’re also investing in mental health and wellness programs to attract and retain top talent.

The boardroom is shaking up, too. Forty-three percent of energy firms added directors under 40 in 2025. Young leaders demand ESG accountability, tech fluency, and a clear vision for the future. They’re pushing for more diversity, more transparency, and more accountability at every level.

Collaborative workforce planning is the new norm. Companies are partnering with tech firms, universities, and even competitors to build talent pipelines and share best practices. This is a recognition that no single company can solve the talent crisis alone.

But let’s not sugarcoat it.

The challenges are immense, and the stakes are high.

The energy sector is facing a perfect storm of demographic shifts, technological disruption, and policy uncertainty.

The workforce is aging, talent is fleeing, and layoffs are pruning the very expertise needed to navigate the transition.

Companies that survive will be the ones who stop pretending and start rebuilding.

The rest?

They’ll be relics, remembered only for their stubbornness.

So what does this mean for executives? The message is clear: stop pretending “steady” is good enough. It’s not. If your workforce isn’t evolving, you’re falling behind. Invest in reskilling now.

Partner with tech firms, universities, and even competitors to build talent pipelines. Embrace hybrid talent. Hire from automotive, aerospace, and tech sectors. Adaptability beats industry experience.

For workers, the choice is just as stark: cross-train or get left behind. Learn data analytics, robotics, or carbon accounting. Negotiate relentlessly.

Demand reskilling stipends, mentorship, and clarity on your role in the energy transition. The future belongs to those who can adapt, learn, and lead in a rapidly changing world.

But let’s go even deeper. The energy sector’s challenges aren’t just about jobs and skills, they’re about culture, leadership, and vision. The old ways of doing things simply don’t work anymore. The sector needs to reinvent itself from the ground up, and that starts with leadership.

Leadership is more important than ever. The best companies are investing in leadership development at every level, from the front lines to the boardroom. They’re building cultures of innovation, accountability, and continuous learning.

Diversity and inclusion are no longer optional. The sector needs fresh perspectives and new ideas to navigate the transition. Companies that fail to embrace diversity will struggle to attract and retain the best talent.

Transparency and communication are critical. Workers want to know where the company is headed, what their role is, and how they can contribute to the mission. Companies that communicate clearly and honestly will build trust and loyalty.

Purpose matters. The next generation of workers wants more than just a paycheck. They want to work for companies that are making a positive impact on the world. The energy sector has a unique opportunity to lead the charge on climate, but only if it can articulate a compelling vision for the future.

The energy sector’s “steady” job numbers aren’t a sign of health… they’re the calm before the storm.

The workforce is aging, talent is fleeing, and layoffs are pruning the very expertise needed to navigate the transition. Companies that survive will be the ones who stop pretending and start rebuilding.

Adapt now, or join the dinosaurs. This is what’s happening. This is what’s really happening. Choose your side.

Workforce by the Numbers:

Total energy services jobs (May 2025): 638,876

Change from April 2025: -1,391

Texas jobs: 311,324 (nearly 50% of the sector)

Other key states: Louisiana (53,346), Oklahoma (48,618), Colorado (25,938), New Mexico (23,894), California (23,383), Pennsylvania (23,127), North Dakota (19,896), Wyoming (14,822), Ohio (10,605), Alaska (9,903), West Virginia (9,775)

Layoffs (2025):

Chevron: 8,000

BP: 4,700

Department of Energy: 1,200–2,000 (plus 2,700+ voluntary resignations)

NREL: 114

Bonneville Power Administration: 130 (plus 300 buyouts/early retirements)

Talent Trends:

Average external job offers per energy professional (2025): 6.08

Percentage of offers from outside the sector: 40%

Salary increases for key roles: Up to 18% year-over-year

Automation impact: 30% fewer workers on drilling rigs since 2020

Renewable infrastructure job growth (2025): 12%

Oilfield workers cross-trained for renewables: 3%

Leadership and Culture:

Directors under 40 added in 2025: 43% of energy firms

Companies lacking a clear workforce strategy for the transition: 68%

This is the full picture. This is what’s really happening. The energy services sector is at a crossroads.

Amanda Goodall, CEO of EdgePulse

Workforce Intelligence for CFOs & Investors in Oil, Fintech, and Aerospace

Host of Job Hunt Nevada

Most workforce data is backward-looking, bloated, or built for HR. I work directly with CFOs, investors, and operators to deliver high-signal talent intelligence that informs capital allocation, M&A, org design, and strategic planning. This isn’t generic analysis… it’s tailored, actionable insight built to move markets and guide high-stakes decisions. Click here to reach out today.