The United Airlines numbers look great.

The story underneath?

Totally different.

$UAL Q1 is a masterclass in labor optics... and here’s what no one’s talking about.

Sales/Support down. ⬇️

Operations up. ⬆️

Heads are being moved to international routes where margins live.

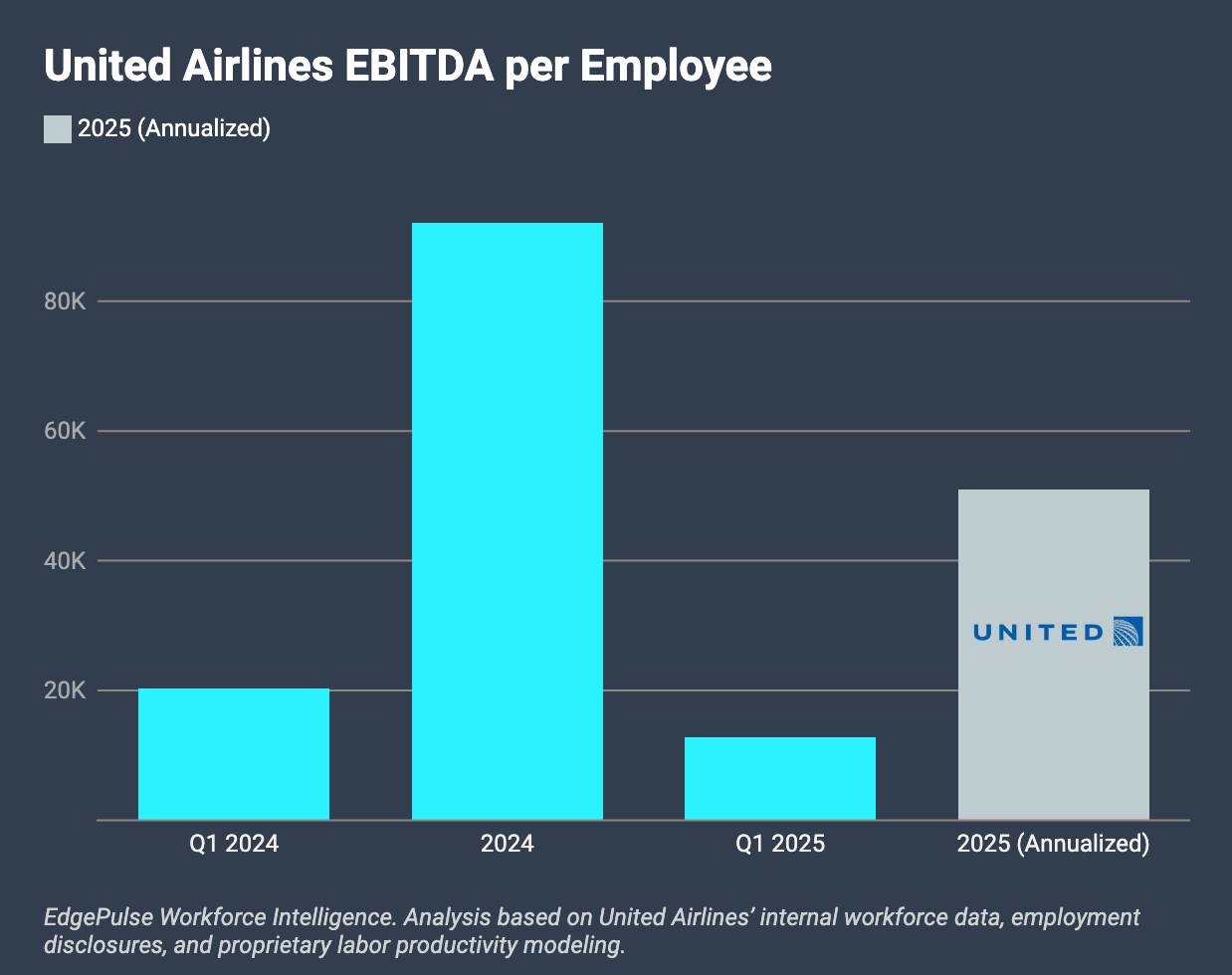

Now for the SHOCK factor: (Employee EBIDTA chart below)

Q1 2024: $20,262 per employee

Q1 2025: $12,760

𝗧𝗵𝗮𝘁’𝘀 𝗮 𝟯𝟳% 𝗱𝗿𝗼𝗽 𝗶𝗻 𝗽𝗿𝗼𝗱𝘂𝗰𝘁𝗶𝘃𝗶𝘁𝘆 𝗬𝗼𝗬 𝘆𝗮'𝗹𝗹!!!!!

EBITDA per employee stalled.

Interns padded headcount. Attrition did the rest.

So what's the workforce POV? Unions are ready to pounce.

• AFA: 99.99% strike vote

• Teamsters: public scope fight

• IAM: contract talks hit in May

United’s adding 36 mainline jets this year which means 𝗻𝗲𝗮𝗿𝗹𝘆 𝗮𝗹𝗹 𝗴𝗿𝗼𝘄𝘁𝗵 𝗶𝘀 𝗰𝗼𝗻𝗰𝗲𝗻𝘁𝗿𝗮𝘁𝗲𝗱 𝗶𝗻 𝘁𝗵𝗲 𝗕𝟳𝟯𝟳 𝗠𝗔𝗫 𝗮𝗻𝗱 𝗔𝟯𝟮𝟭𝗻𝗲𝗼/𝗫𝗟𝗥, 𝘄𝗵𝗶𝗰𝗵 𝗶𝘀 𝗮 𝗹𝗼𝗻𝗴-𝘁𝗲𝗿𝗺 𝗯𝗲𝘁 𝗼𝗻 𝗳𝘂𝗲𝗹 𝗲𝗳𝗳𝗶𝗰𝗶𝗲𝗻𝗰𝘆, 𝗴𝗮𝘂𝗴𝗲 𝘂𝗽𝘀𝗶𝘇𝗶𝗻𝗴, 𝗮𝗻𝗱 𝗶𝗻𝘁𝗲𝗿𝗻𝗮𝘁𝗶𝗼𝗻𝗮𝗹 𝗺𝗮𝗿𝗴𝗶𝗻 𝗿𝗼𝘂𝘁𝗲𝘀. 👈

Some good news for $UAL - Fuel is down again this week.

208.86 cts/gal in North America. That’s a 12.3% YoY drop.

But don’t mistake that for margin health. Fuel is buying time. Buying calm.

United’s playing it smart in some areas:

International RASM is climbing.

Premium cabins are full.

Scheduling is best it has been in years.

They’re not broken.

But UAL is having a moment and in places they don’t want to talk about.

TLDR for $UAL- the crew is absorbing tension. If you want the real story?

Watch ground crew attrition.

Watch IAM in May.

Watch EBITDA per employee stall out again in Q2.

This isn’t a win.

It’s a warning.