Bank of America just dropped a Q1 earnings bomb. 𝗟𝗶𝗸𝗲 𝗪𝗢𝗪.

EPS at $0.90 (vs. $0.82 consensus) and revenue at $27.4B (vs. $26.9B) screams resilience, powered by a cost efficiency streak that’s practically Machiavellian (those layoffs weren’t for nothing).

Back in early March, I projected that Bank of America’s focus on risk management hires and lending restraint would pay off... and Q1’s beat shows I was right on the money.

The most shocking - or rather, standout aspect of Bank of America’s Q1 2025 earnings is its ability to deliver 18% YoY EPS growth and maintain a fortress-like balance sheet (CET1 at 11.8%, $2.0 trillion in deposits) while dealing with this challenging economic landscape.

The market liked it too and stock’s up 4.45% to $38.30 as of this writeup.

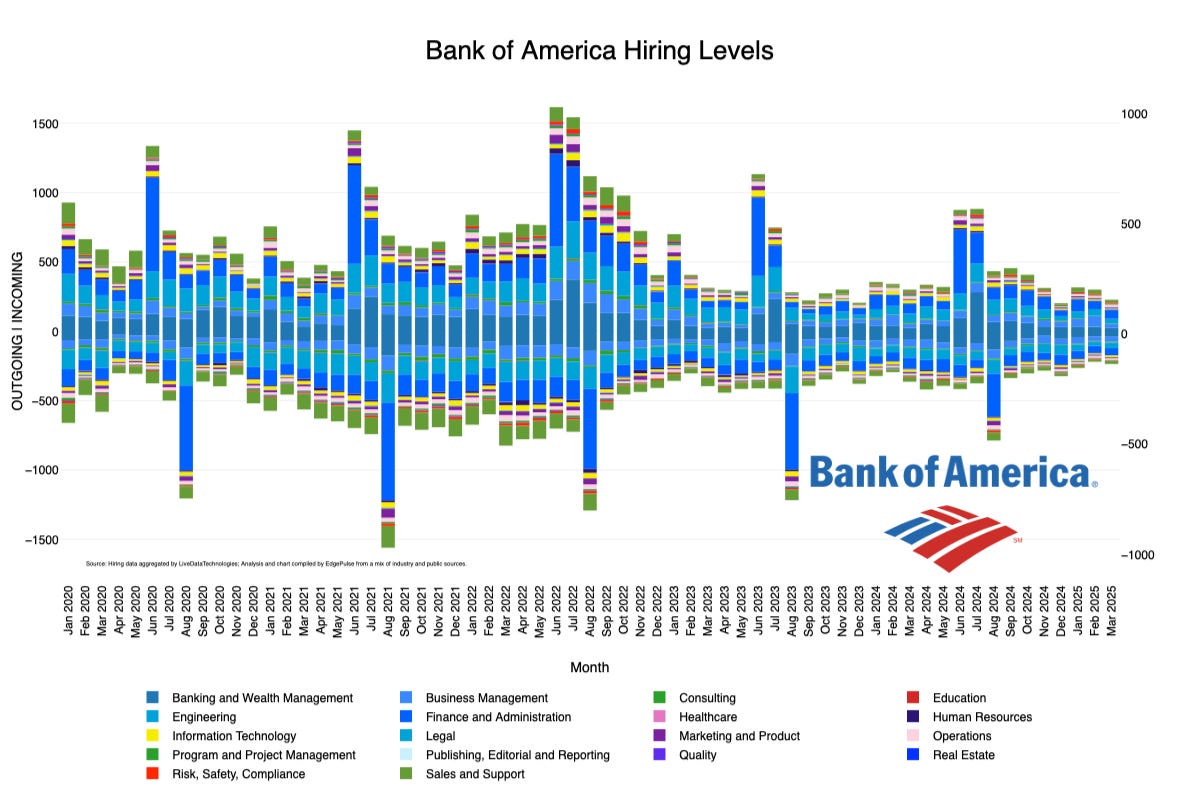

𝗕𝘂𝘁 𝘁𝗵𝗲 𝗿𝗲𝗮𝗹 𝘀𝘁𝗼𝗿𝘆? 𝗜𝘁’𝘀 𝗶𝗻 𝘁𝗵𝗲 𝗵𝗲𝗮𝗱𝗰𝗼𝘂𝗻𝘁.

I’ve been dissecting BofA’s workforce moves since 2020, and Q1 2025 is a masterstroke of defensive brilliance.

Risk and compliance hires (think Risk VP) are a calculated bet against a $86.57B CRE exposure on a $957B industry-wide debt maturity cliff.

𝑻𝒂𝒍𝒌 𝒂𝒃𝒐𝒖𝒕 𝒃𝒖𝒊𝒍𝒅𝒊𝒏𝒈 𝒂𝒓𝒎𝒐𝒓. And it’s probably why their earnings didn’t buckle under the CRE issues.

𝗣𝗿𝗼𝗮𝗰𝘁𝗶𝘃𝗲? Sure.

𝗦𝗲𝘅𝘆? Not a chance.

𝗘𝗳𝗳𝗲𝗰𝘁𝗶𝘃𝗲? You bet.

Then there’s the client-facing side - Sales, Support, Banking, Wealth Management - It was just 0.04% of 202K total staff. 𝗚𝗿𝗼𝘄𝘁𝗵? 𝗛𝗮𝗿𝗱𝗹𝘆.

Critics might call it stagnation... 𝗜 𝗰𝗮𝗹𝗹 𝗶𝘁 𝗸𝗻𝗼𝘄𝗶𝗻𝗴 𝘄𝗵𝗲𝗿𝗲 𝘆𝗼𝘂𝗿 𝗯𝗿𝗲𝗮𝗱’𝘀 𝗯𝘂𝘁𝘁𝗲𝗿𝗲𝗱, and it’s not in overextending right now.

Look at their reserve multiple: it ticked down. Charge-offs held steady. Delinquencies are inching up.

They’re playing for time.

The signal’s not in the 8-K.

It’s in the hiring pattern.

And I called it.

Meanwhile, BofA’s capital markets are flexing. Their new Contingent Income Issuer Callable Yield Notes (8.00%-8.50% coupons) aren’t just a cash grab - they’re proof of creditworthiness, locking in funds before economic headwinds (tariffs, anyone?) rattle the indices they’re tied to (Nasdaq-100, Russell 2000, S&P 500).

𝗔𝘀 𝗲𝘃𝗲𝗿𝘆𝗼𝗻𝗲 𝗹𝗶𝗸𝗲𝘀 𝘁𝗼 𝘀𝗮𝘆 𝘁𝗵𝗲𝘀𝗲 𝗱𝗮𝘆𝘀... 𝗜𝘁’𝘀 𝗰𝗵𝗲𝘀𝘀, 𝗻𝗼𝘁 𝗰𝗵𝗲𝗰𝗸𝗲𝗿𝘀... 𝗮𝗸𝗮, 𝗿𝗮𝗶𝘀𝗲 𝗰𝗮𝗽𝗶𝘁𝗮𝗹 𝗻𝗼𝘄, 𝘁𝗵𝗿𝗶𝘃𝗲 𝗹𝗮𝘁𝗲𝗿.

So yes, Q1’s a win, but it’s not a fairy tale. CRE risks don’t vanish with a few smart risk hires ya'll, and lending’s on ice for a reason uncertainty’s brewing.

This is BofA playing the long game, not chasing short-term glory. Investors who rode the earnings pop, good for you. Long-term? Keep an eye on that lending capacity and CRE exposure.

My take is that Q1’s a high note, but could full-year EPS dip below $3.65 if the macro turns sour? I'm watching this. It will have big effects on layoffs and hires.

In banking, it’s not about looking pretty, it’s about staying alive. And like most on Wall Street right now... BofA’s doing both... for now.