Phillips 66 and Activist Elliott Split Boardroom

Proxy Battle is Done - here are the Investment Signals you want.

𝗠𝗶𝗱𝘀𝘁𝗿𝗲𝗮𝗺, 𝗖𝗵𝗲𝗺𝗶𝗰𝗮𝗹𝘀, 𝗖𝗼𝗿𝗽𝗼𝗿𝗮𝘁𝗲 - 𝘄𝗮𝘁𝗰𝗵 𝘆𝗼𝘂𝗿 𝘀𝗶𝘅.

Results are in: Phillips 66 vs Elliott Investment Management L.P.

The activist won 2 out of 4 board seats as I expected.

Elliott is all over this reorg right now.

𝗧𝗵𝗲 𝘄𝗼𝗿𝗸𝗳𝗼𝗿𝗰𝗲 𝘀𝗵𝗼𝘂𝗹𝗱 𝗲𝘅𝗽𝗲𝗰𝘁 𝗰𝗵𝗮𝗻𝗴𝗲.

Elliott explicitly wants to spin off Midstream and the Chevron JV (CPChem). aka- Restructure at scale.

Cornelius and Heim - Elliott’s successful nominees - are now inside. And while Elliott didn’t get a full sweep, this isn’t a loss. It’s a wedge. A pretty hefty one ya'll.

It wasn’t without a fight… one one of a helluva spreadsheet. Elliott’s plan to break up $PSX could cost $28/share in dis-synergies and disrupt a workforce tied to $14B+ in shareholder returns. - Haskett

Adjusted loss: $368M. Shareholder return: $716M.

ISS, Glass Lewis, and Egan-Jones all backed Elliott’s full slate - and it paid off, at least in part.

Elliott walked away with 2 out of 4 seats on the $PSX board.

Not a sweep, but enough to move the needle.

Meanwhile, BlackRock, Vanguard (yep- that Vanguard 👀), and State Street sat quiet. They control 23% of shares and didn’t back Elliott - but Elliott still broke through.

This is the playbook:

Even partial wins = leverage. Enough to press “Streamline 66” into motion.

Elliott has historically driven cost cuts, divestitures, and layoffs with just a foot in the door.

Here’s what to expect next:

– Q2 earnings & forward guidance: late July → that’s when the tone will shift.

– Budget resets & operational reviews: Aug–Sept → already picking up signals (more intel by July).

– Layoff announcements: Watch for them to hit Q4 earnings.

This isn’t over. This is just the beginning.

Job𝘀 𝗮𝘁 𝗥𝗶𝘀𝗸:

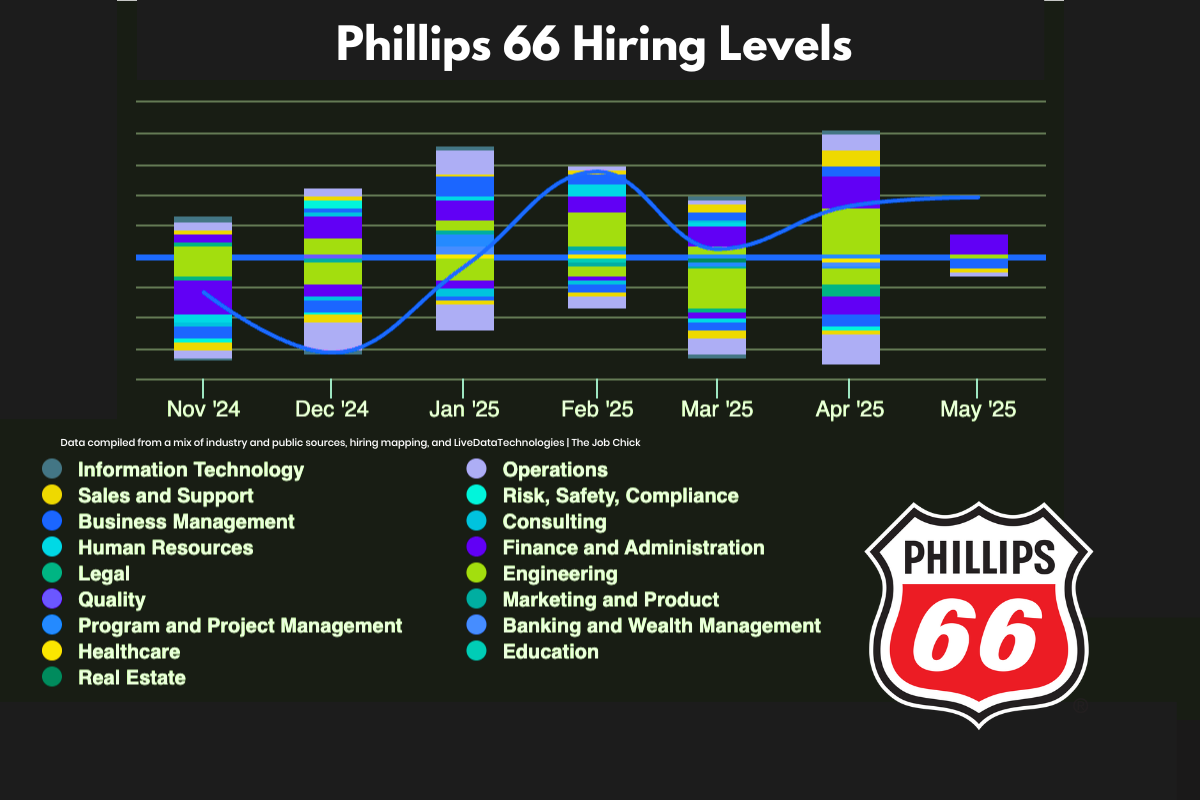

Operations: Heavily volatile. High job losses in Nov, Mar, and Apr - despite occasional gains. Likely target of cost-cutting or automation efforts.

Sales & Support: Consistently low performance. Job ends outpaced starts 4 of the 6 months. Signals sluggish demand or budget tightening.

Program & Project Mgmt: Ended strong in April, but earlier losses suggest reorgs or reprioritization of internal projects.

Healthcare & Education: Low but slightly negative overall trend - potential early signs of softening in these sectors.

Engineering & IT: Despite fluctuations, they’re generally positive. Most hiring occurred Jan–Feb and April - likely tech buildouts or infrastructure investments.

Legal & Compliance: Jumped in April - could correlate with M&A, restructuring, or regulatory prep.

Overall Trend:

November and December ‘24: More job ends than starts, particularly in Operations, Sales, and Program/Project Management.

January and February ‘25: Net job growth - more starts than ends. Sharp rebound in Information Technology, Operations, and Engineering.

March ‘25: Reversal again - higher job losses, especially in Operations.

April ‘25: Strongest month for net job creation in the 6-month window. Growth driven by Program Management, Legal, and Engineering.

May ‘25 (early data): Slight downturn again, with a small net loss. Sales and Healthcare see the biggest cuts.

With Elliott securing 2 board seats, the internal tone WILL shift.

Even without a full takeover, activist pressure forces operational realignment - typically within 2–3 quarters.

Past Elliott playbooks show workforce reductions within 120–180 days after board placement. So yes, we are looking at Q3-Q4 here.

Financial repositioning is also going to be underway…

Adjusted Q1 loss of $368M, yet $716M returned to shareholders. This is the signal the internal cost review phase is active. They’re paying out while quietly repositioning.

Expect hiring freezes now, followed by role consolidation this summer.

June–July: Budget reviews + early voluntary exit packages (quiet phase)

August–Sept: Internal headcount caps issued, reorg maps drafted

Q4 Earnings (Jan ‘26): Formal layoff announcements, likely under the banner of “strategic realignment” or “focus on core business”

I’ll let you know as soon as I start getting the intel… Subscribe so you don’t miss out.

Between oil and aviation, Elliott’s latest move screams they are betting on global dysfunction, energy volatility, and the power vacuum it creates.

Yes they hold 5% of $BP + $1B in PSX 0.00%↑ - but there is more.

O&G: Elliot is in a high-stakes geopolitical pipeline play with the Russian/Bulgarian TurkStream extension.

TRAVEL: Southwest is quietly going global... with Elliott pulling the strings. Icelandair deals. 50 new routes across Mexico & the Caribbean.

And ya'll... don't forget- they now control 11% of Southwest - with rights to purchase more shares by July 2025. Lots to watch.

If jet fuel stabilizes, $LUV could be in a decent spot. Elliott’s stake in $BP signals a good bit of confidence in energy plays - they’re betting on refining margins holding, not a major price drop.

Lots happening. You know I’m your girl for all the workforce signals before they become headlines. Talent is the New Alpha.

-Amanda Goodall, The Job Chick & CEO, EdgePulse.

I work with exec teams, founders, and investors who want to make smart workforce decisions - before the headlines hit. If that’s you, let’s talk.