Southwest ($LUV): Elliott’s Labor Edge Powers 20–30% Upside

Shock Factor: Nine insiders, including Elliott Management’s David Hess (up 47.9% with a $199K bet), poured $1.2M into Southwest Airlines ($LUV) from April to May 2025, right before bag fees (starting May 28), premium seats, and a $2.5B buyback. The market’s missing a $1.1B labor unlock.

At the closing bell, June 23, 2025, $LUV was up 1.5% on the day, but this labor-driven pivot could lift it 20–30% to $34–$36 in 12–18 months, with $40 by 2026.

Here’s why it’s a Buy.

Southwest, a 54-year icon, is rapidly transforming under Elliott Management’s 11% stake and five board seats, where their proven labor efficiency strategy (e.g., 20% returns at Hess Corp) hinges on workforce changes.

This is about its 74,000 workers, not planes. In Q1 2025, Elliott cut 1,750 corporate jobs, ending a 54-year no-layoff streak, and froze pilot hiring despite 50+ new routes, targeting $210M in savings this year and $300M by 2026.

Labor costs rose 9.8% in 2024 amid tariff demand dips (Q1 loss: $149M), prompting a workforce overhaul. The goal? Boost EBITDA/employee from $34.5K (2024) to near Delta’s $65.3K, unlocking $1.1B in margins with a $15K gain per worker over 18 months.

Talent is the New Alpha

Talent drives this shift, rooted in workforce changes: The 1,750 cuts, representing 15% of headquarters staff (estimated at 10,000–12,000), save $120K per job on average, including benefits. With 70% of savings phased in by Q4 2025 as severance costs taper, the focus shifts to frontline pilots, flight attendants, and ground crew, reshaping the labor hierarchy.

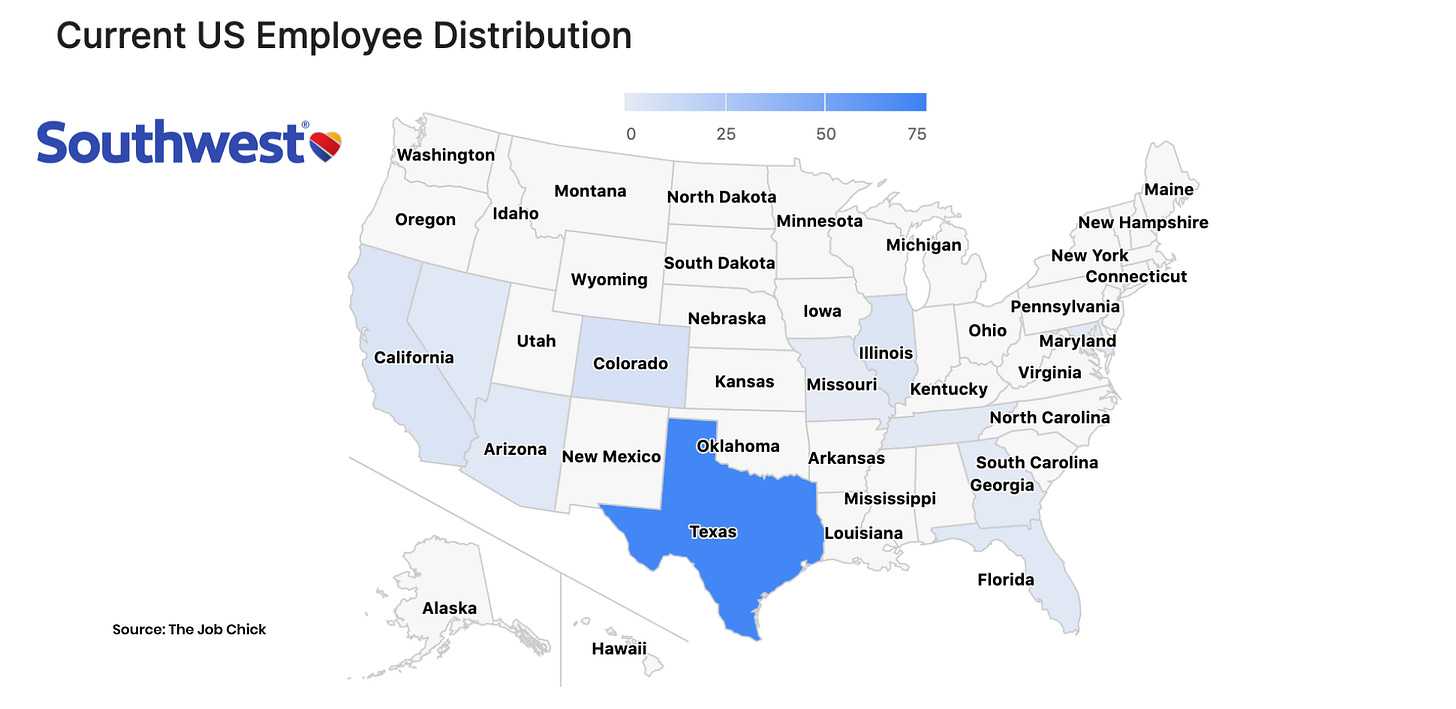

#1 HQ holds the largest employee share, but cutting 15% of corporate workforce/leadership at once? My, my, my. There is something more here they are trying to deal with. Texas, where Southwest is headquartered, holds the largest share of employees - so needless to say, looks like a big hit to the lone star state employees.

#2 From Jan 2024 to Feb 2025, staff-level hires (blue) dominated, while the overall employee count declined after mid-2024. Despite fewer leadership positions, the cost of senior roles is significantly higher. It appears the big departures the past 2 months have been in HR, Operations and Business Management as well.

Not unusual - but overall leadership costs became unsustainable. Hence why we are where we are at now!

This is a fraction of what I can see in the airlines industry right now. I am expecting a few other layoffs to follow.

Pilot Freeze: No new hires stretch the existing 10,000 pilots, pushing them 10–15% more hours amid route expansion. Training for 5,000 workers to handle new operational demands such as international protocols and overnight turns, began in Q2 2025, involving simulator sessions and safety briefings. Gains lag 12–18 months due to aviation’s slow labor cycle.

We will want to also look at:

Southwest Airlines is having a moment with fees... but the real story? It’s happening in the cockpit.

After a few near-misses at U.S. airports, they’re retrofitting 800 planes with Honeywell Aerospace Technologies system that warns pilots if they’re landing too fast, using the wrong runway, or mistaking a taxiway.

Why? Because the post-COVID system is stretched way too thin:

▪️ Inexperienced pilots

▪️ Burned-out controllers

▪️ Fatigue everywhere

𝗕𝘂𝘁 𝘁𝗵𝗶𝘀 𝗶𝘀𝗻’𝘁 𝗷𝘂𝘀𝘁 𝗮𝗯𝗼𝘂𝘁 𝘀𝗮𝗳𝗲𝘁𝘆 𝘁𝗲𝗰𝗵 -- 𝗻𝗼𝘁 𝘄𝗶𝘁𝗵 𝗺𝗲 𝗹𝗼𝗼𝗸𝗶𝗻𝗴 𝗶𝗻𝘁𝗼 𝗶𝘁 𝗮𝗹𝗹.

Behind the scenes, Southwest is shifting its entire model:

Still point-to-point… but now with 𝗺𝗼𝗿𝗲 𝗰𝗼𝗻𝗻𝗲𝗰𝘁𝗶𝗼𝗻𝘀, 𝗿𝗲𝗱-𝗲𝘆𝗲𝘀, 𝗮𝗻𝗱 𝗻𝗲𝘁𝘄𝗼𝗿𝗸 𝗰𝗼𝗺𝗽𝗹𝗲𝘅𝗶𝘁𝘆.

Translation:

▪️ Longer duty days for crews

▪️ More overnight shifts

▪️ Baggage ops getting slammed

▪️ Scheduling chaos brewing

Ya gotta zoom out here:

We keep optimizing routes and retrofitting jets.

Maybe it’s time to invest as aggressively in the humans keeping it all in the air.

Southwest pilot hiring remains frozen... the consequences of last year’s over-hiring and under-planning.

That’s the story I’m watching that could cause a bit of havoc.

Crew Push: Flight attendants and ground staff face increased red-eye shifts and baggage volumes. Honeywell safety technology (deployed across 800 jets starting Q2 2025) and a $500M IT upgrade (scheduling and fatigue management, Q2 2025) curb the 2022 $800M meltdown risk, though morale is tested.

Unions: With 85% unionized (e.g., SWAPA, TWU), 22% raises costing an estimated $200M challenge savings. Q3 2025 productivity talks could align 60%, though delays are possible.

This 12–18 month labor boost proves the $1.1B target, with savings cutting costs roughly 2–3%.

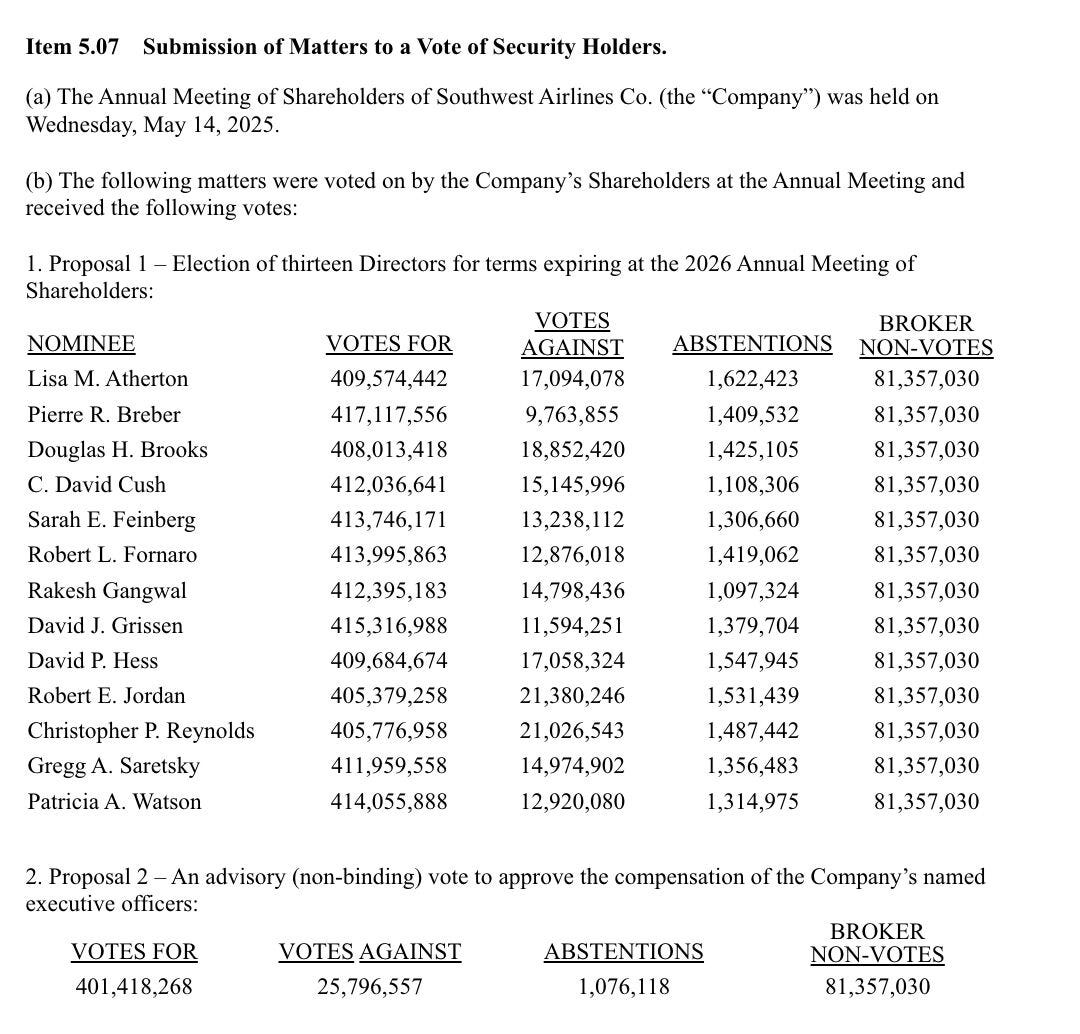

Insiders Hess, Saretsky, Gangwal, Grissen, Watson, Reynolds, Fornaro, Feinberg, Cush filed Form 4s for 46,000 shares at approximately $1.2M (April 29–May 16, 2025), per SEC data. Hess’s $199K buy on April 28, before bag fees, signals confidence. The $2.5B buyback (75% complete by July 2025, October 2024) lifts EPS about 10%.

Elliott’s stake in BP suggests confidence in stable fuel markets which is critical as Southwest CEO Bob Jordan flagged tariff and fuel cost pressures on April 25, 2025

.

Risks include union pushback and crew strain, mitigated by tech and talks. Financially, $300M adds $0.52/share EPS (570M shares), with a $500M bull case ($0.88). At 6x EV/EBITDA (peers 8–10x), $LUV could hit $34–$36, per Deutsche Bank’s $40 target (May 2025). Q1’s 3.5% RASM growth and $6.4B revenue (April 25) show resilience, despite a 13.7% drop from $36.12 (December 2024).

This targets 3–6 months with upside to two years. Near-term, Q2 earnings (July 25, 2025) and bag fees could drive $32–$34. And look at where it is TODAY. June 27th, 2025

So while I am critical and watching workforce intel like a hawk… Long-term, labor gains and buyback aim for $40 as they mature. Buy $LUV - $31.88 hides a $1.1B labor unlock.

From ‘Luv’ to lean, this is an undervalued workforce gem.

For full reports and signals, reach out to Amanda Goodall- The Job Chick