Last week was all noise and narrative control. But you can’t distract forever, especially not from the labor data, the layoffs, and the financial behaviors getting baked into every HR dashboard behind the scenes.

Let’s rewind.

Southwest Airlines. People about lost their mind after CEO, Bob Jordan stated at Southwest Investors Day September 2024 - "We are passionate about those policies, in particular, two bags fly free," CEO Bob Jordan said at the company's Sept. 26, 2024, Investor Day. "Not only because they're part of our history," Jordan continued, "… but because our extensive data-driven research … shows that they are the right economic choice."

Yeah, I know everyone saw the bag fees headline, maybe griped about it on X, but I’m telling ya’ll… you missed the real play.

This isn’t a company in crisis. It’s a company under new leadership… activist leadership.

Elliott Management stacked five board seats and shareholders just nodded in approval like “go fix it.”

You’re mad about $35 to check your bag.

The board? They’re congratulating themselves with fresh stock awards.

Oh and that 1,750-person leadership cut? Not random.

You now have a liquidity-rich, activist-backed airline with a greenlit playbook for restructuring, pricing resets, and yes, probably buybacks down the line. Southwest isn’t going under. It’s going corporate. That culture you thought they’d never change? Watch.

Lockheed Martin’s Q1 numbers looked okay until you read them.

Ending backlog at $173 billion. Delivered only $18 billion.

That’s a problem.

F-35 deliveries are resuming, but they’re dragging profits, again, and digital transformation spending is up 38% with no clear return.

Oh, and they say headcount is “stable,” which is the new way of saying “we’ll cut you if you’re not core to margin.”

So not every job is at risk. But the ones that are? They’ll hit hard.

It’s not just manufacturing. It’s the ops teams, the finance arms, the mid-level layer you don’t see on LinkedIn.

Watch what happens quietly over the summer.

General Mills flagged $70 million in charges tied to layoffs. About 1,000 jobs.

Maybe more.

Their pet food line is flat. Snack sales are weak.

Innovation, in 2025, now just means “fire people and tell Wall Street you’re pivoting.” Stock’s down 15% this year.

The easy money years are over. We’re entering the cost containment era.

Then there’s Best Buy, who frankly impressed me.

China-sourced product costs were at 55% in March. By May? Down to 30–35%. That is a monumental shift in supply chain reliance.

And the quote that stuck: “The increased product costs flowing to us are lower than the tariff rates.”

That’s not survival. That’s power. That’s how you flex quietly in an earnings call, while everyone else is panicking over shipping routes and warehousing costs.

And yes, Microsoft.

Everyone’s favorite “safe” tech giant is back on its performance management villain arc. 6,000 people gone in May, and now another 300+ scheduled to exit by August. Permanent cuts in Redmond.

And don’t think for a second that’s it.

They rolled out a ruthless new policy overhaul:

2-year rehire ban if you were cut for “performance,” a new “good attrition” metric to track if they were glad you left, and a choice: take 16 weeks severance or roll into a PIP with zero parachute if you fail. Five days to decide.

Cold. Corporate. Classic 2025.

This is the Amazon “unregretted attrition” model, just rebranded. And it’s spreading.

ULCCs are wobbling. The crew churn numbers I track are getting spicy. The workforce isn’t buying the budget airline hustle anymore.

Mid-level roles are quietly exiting.

Pilots aren’t waiting around.

My models show late Q3 and Q4 pain, not on paper, but in people. And the signals are showing now.

Still hard to talk about. I flagged it back in January. It hits July 31.

700 layoffs in La Vergne, Tennessee - a town of 39,000.

Production workers made about $22 an hour.

Maintenance techs? $25.

That money doesn’t just disappear.

It leaves the community. It hits schools, gas stations, childcare, the entire ecosystem.

And Bridgestone? They called it “optimizing their footprint.” This is what happens when operational efficiency meets spreadsheet strategy.

Now let’s talk BNPL and workforce surveillance.

Let me be blunt: This isn’t paranoia. It’s data. You miss a few payments. Take too many payroll advances. Start showing signs of burnout.

That’s not just your problem anymore… it’s your employer’s problem. At least according to their HR system. Because now?

They’ve got platforms feeding them retention analytics, risk scores, and behavioral flags.

Equifax. Experian. TransUnion. They’re not just selling credit data anymore. They’re bundling income history, employment verification, payment behavior, and feeding it straight into the HR tech stack.

So when you apply for a job and get ghosted? It might not be the interview. It might be the BNPL burrito you financed last week.

I wish that were a joke. But it’s not. And the the thing is - You agreed.

Quiet consent. You clicked the terms.

No one told you this data would be sold to hiring managers. But it is. Right now.

Retention is being engineered. Through employer-linked wallets. Through paycheck routing systems that “reward” you for staying, and punish you for leaving.

You get low-interest payroll BNPL.

“Perks” for leaving your wages in the company’s wallet.

And if you leave? You lose it all. Loyalty used to be earned. Now it’s rigged.

So where does this all go?

More to come on this soon. This seemed to strike quite a nerve on X. I feel I need to unleash the company names that do this.

Here’s what I’m watching this week:

JOLTS hits. But here’s the truth: JOLTS isn’t about hiring. It’s not even about actual quitting.

It tracks intent. “We plan to hire.” “We plan to expand.”

You know what that means in 2025? Corporate vibes. Nothing more.

Most of these postings? They’re ghost jobs. A post-earnings mirage. Companies flood job boards right after earnings to signal confidence. Not because they’re hiring. But because they want headlines that say they are. It’s job posting as stock price strategy. And it’s working, for now.

Oil and gas numbers are flashing red. I’m watching Halliburton closely. There’s movement happening… pre-layoff movement. You know the drill: reassignments, weird internal town halls, senior leaders suddenly “transitioning.” This is the preamble to the earnings narrative. And unemployment insurance claims in the Permian and Eagle Ford are up. That doesn’t just happen for fun. Something is turning. Q3 will feel it.

And then there is Nvidia.

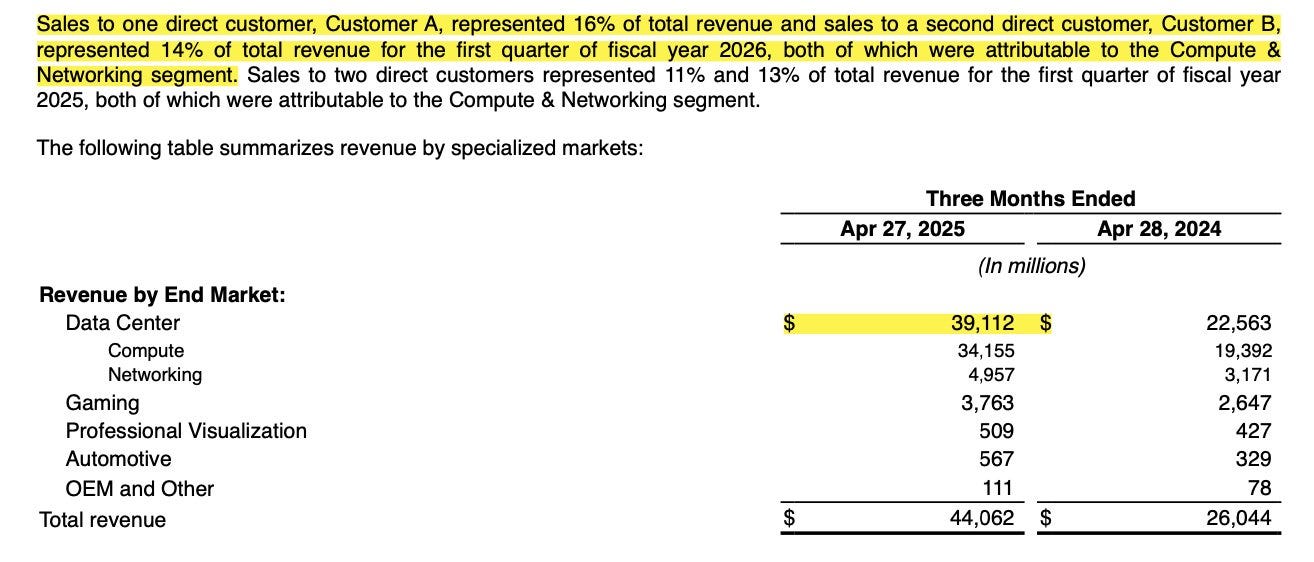

Let’s just say it, the golden child of AI is starting to sweat. They don’t do layoffs. It’s part of the brand. But now they’ve got $5.5 billion in inventory write-downs and $15 billion in lost revenue from export restrictions.

And here’s what really has me watching one-third of Nvidia’s $39 billion in data center revenue comes from just two customers. Two. That’s not robust. That’s fragile. If either one of them cuts back, Nvidia feels it everywhere: hiring, margins, product velocity. This is the problem with concentrated revenue streams - you can’t hedge your way out fast enough. Everyone’s still hypnotized by the stock price. But my models say the real impact hits in Q3 and Q4. Not in product. In people.

Because talent always catches it first.

Look, if you think layoffs are a lagging indicator, you’re already behind.

Workforce Intelligence is the leading edge now.

Not survey data. Not BLS numbers.

Churn models that feed on stress scores, payroll patterns, and behavioral finance signals.

And for the week ahead? I’ll be watching JOLTS. But not for what it tells me about job seekers. I’m watching it for what it reveals about corporate strategy. If job openings spike right after weak earnings? It’s bait. A headline trick. You’ll see it in tech. You’ll see it in retail. You’ll see it in aviation.

I’m also tracking oil. If claims in Texas and New Mexico go up again, we’re in a bad cycle. And if Halliburton slips anything into the press this week? You’ll hear about it from me first. ConocoPhillips is also coming up soon… keep watching my Substack.

Nvidia? Their silence will speak volumes. They can’t move the hiring needle right now without exposing concentration risk. If they stall on engineering hires? That’s your early warning.

And I’ll say it again for those in the back: layoffs don’t hit the front page anymore. They hit the dashboards. The payroll systems. The churn scores.

You want the edge? I can give you the signals. It’s what I do.

And stick with me. Because this week? They’ll try to sell you optimism. I’ll be here to tell you the truth.

— Amanda Goodall, The Job Chick.