You know what I am going to say: If you're only paying attention to the headlines, you're already so far behind it isn’t funny.

The market isn’t calm. It’s pretty darn quiet. And quiet means pressure is building.

The real signals are coming from where they always come from: middle-market staffing, internal hiring slowdowns, insider selling, and financial smoke screens. I’m talking about the stuff no one wants to report on until the house is already on fire.

So let me be blunt:

The warning signs are here. They were here last week. And they’re going to be louder this week.

Let’s start with what ‘just happened’.

Credit Scores Are Collapsing

2.3 million Americans dropped into subprime status in Q1.

That’s a historic surge.

Here’s what else:

2.2M lost over 100 points from their credit score

1M+ dropped over 150 points

Many missed a $440 balance they didn’t even know existed

That means millions just lost access to housing, auto loans, and basic credit tools in less than 90 days.

Then there’s BNPL.

Let me be very clear here: Buy Now, Pay Later is credit dressed in vibes.

130M+ users in the past year (TransUnion)

Heavy users averaged 23 loans (CFPB)

42% missed a payment

Defaults are showing up in collections

Lenders are now reporting to credit bureaus

This is now credit risk at scale, built on tiny debts, fast dopamine, and zero financial literacy guardrails.

And the wildest part? These loans are now being packaged into bonds - underwritten by AI middlemen like Pagaya - and sold to Wall Street.

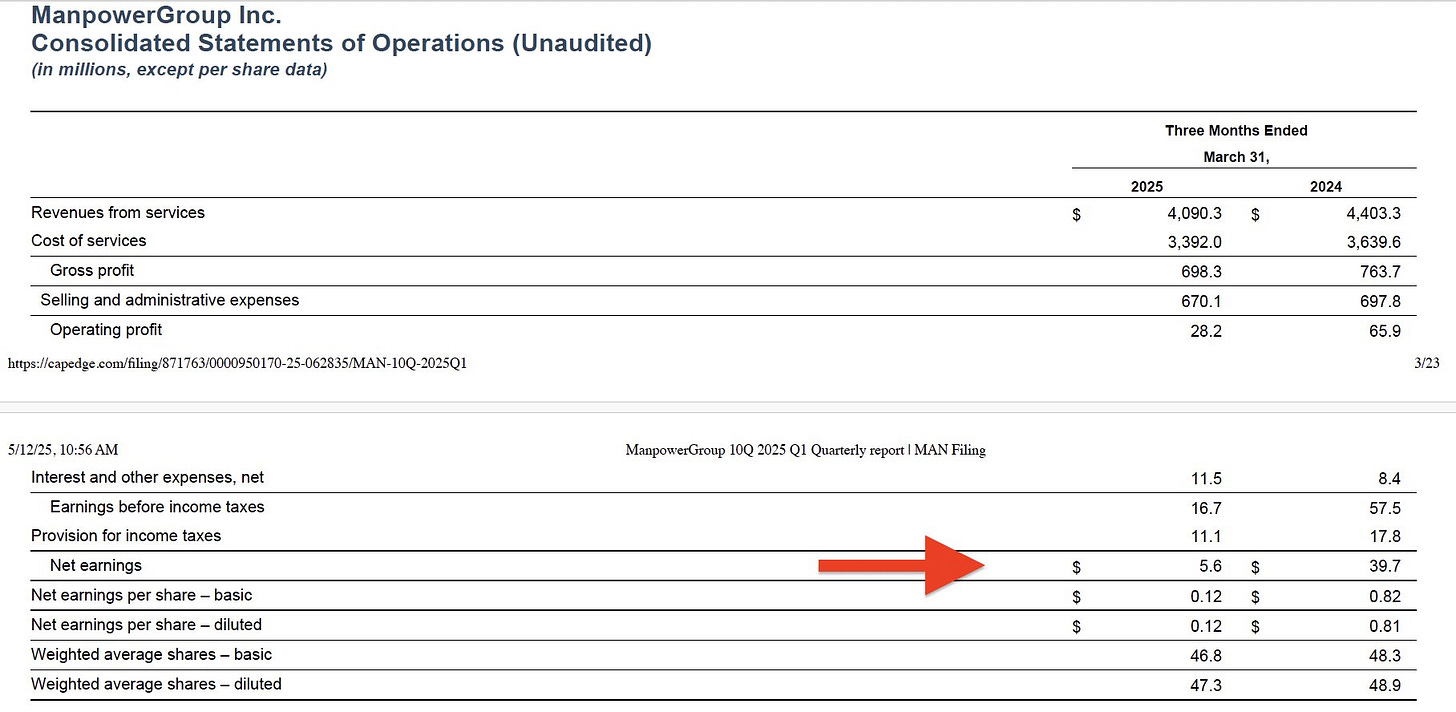

Staffing is one of the FIRST Major Indicators

When ManpowerGroup cuts its dividend 53% and Resources Global cuts 50%...

That's not a cost-saving tactic.

These are the frontline labor suppliers. The middlemen. The ones who feel demand slip weeks before CFOs admit it on earnings calls.

In 2008, this exact same move happened right before the labor market cratered.

In 2020? Same story. Temp hiring went dark before the lockdown layoffs.

And now? It's happening again.

We’re not talking about reductions around the edges. We’re talking about demand collapse in real time.

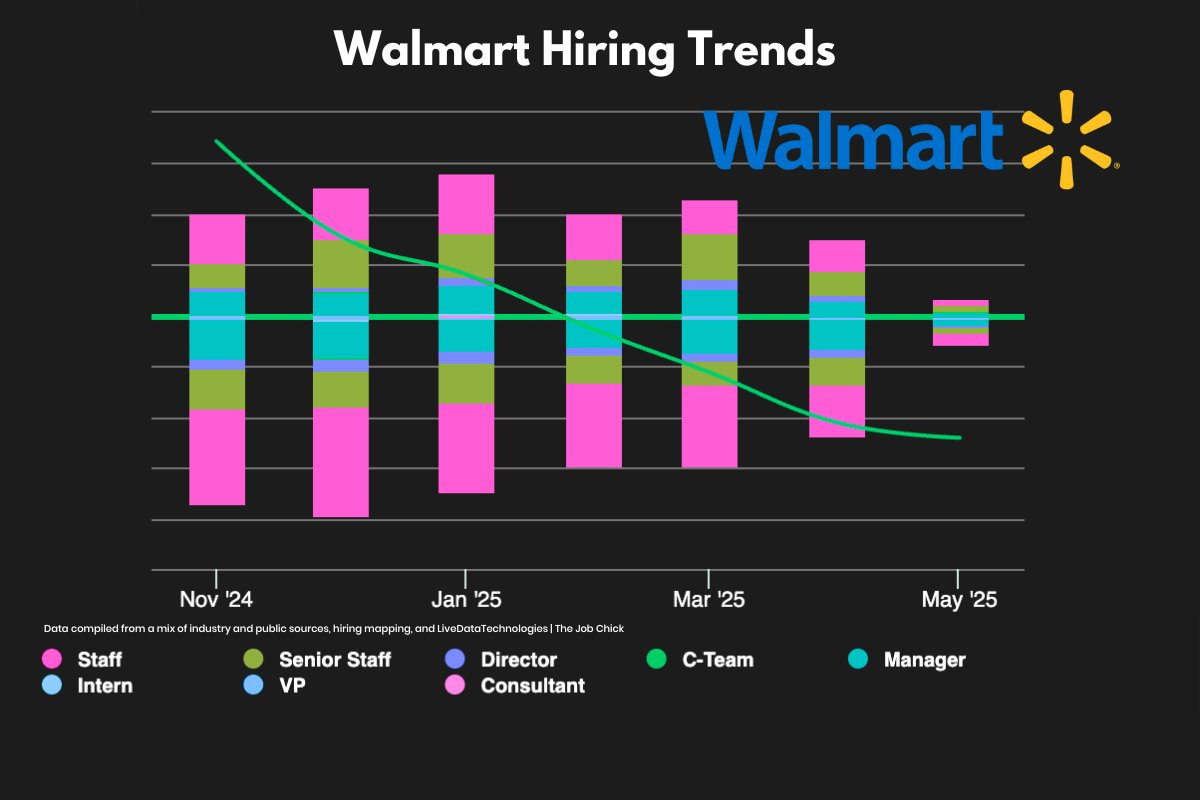

Walmart Showed Us the Future

Walmart pulled in $4.6B in profit last quarter.

Their e-comm was up 22%.

Ad revenue? Up 50%.

Then they cut 1,500 jobs.

Because “efficiency.”

Zoom out and look closer:

Hiring volumes are tanking across all levels

Exits have outpaced hires for 6 months straight

VPs are quietly leaving

Welcome to the blueprint. Copy-paste coming to a boardroom near you.

AI Is Reshaping the Workforce (and No One Is Ready)

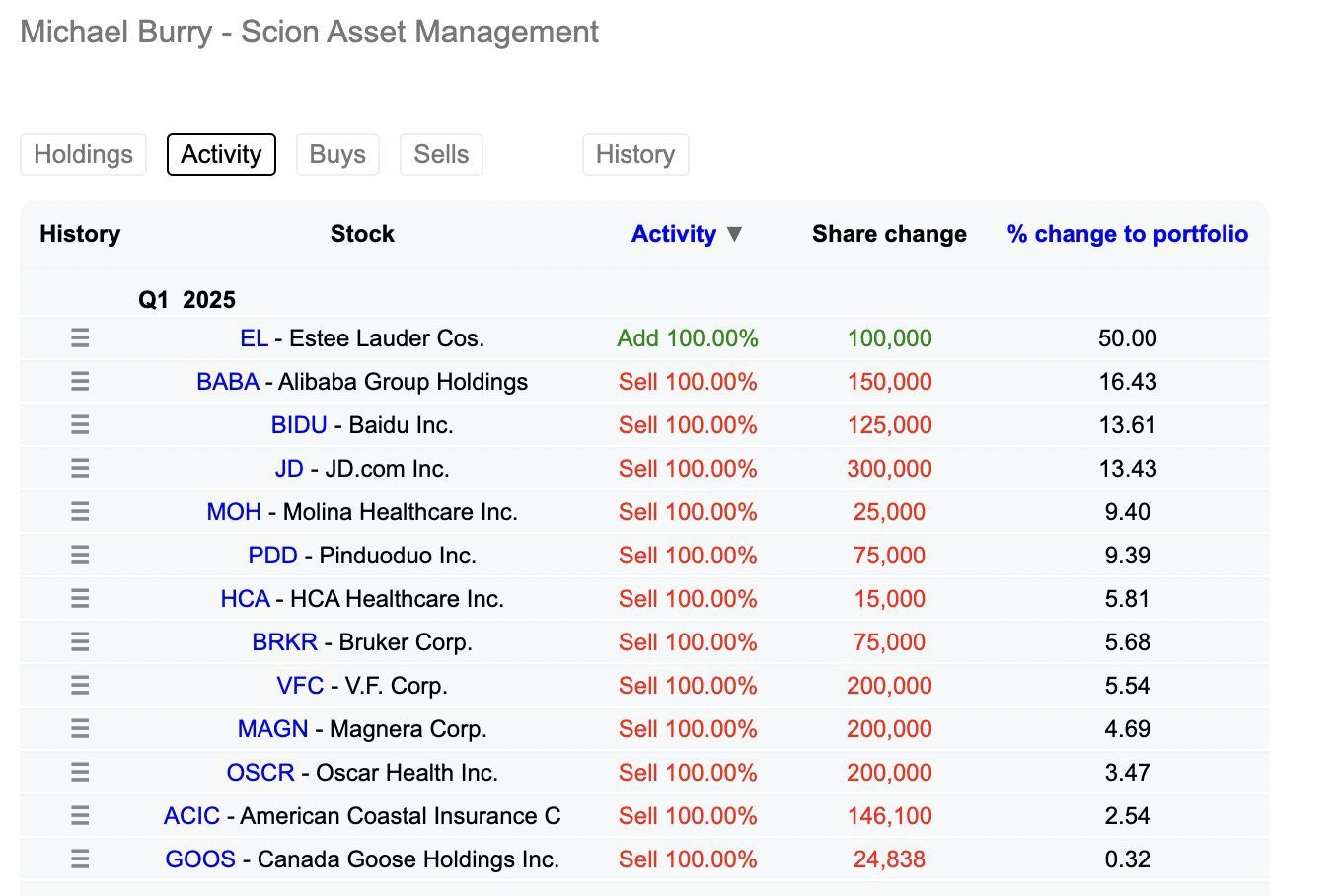

Estee Lauder just embedded AI into its product development core. NOW we know why Michael Burry was all about THIS stock. EL 0.00%↑

Workforce FOCUS:

Fewer traditional scientists

More in-silico researchers

Growth in roles like real-time launch managers

Internal upskilling at speed

We’re seeing the rise of:

AI-curated teams

Agile product cycles driven by real-time data

Legacy layers getting squeezed out

If your resume still says “process improvement” and you haven’t touched a predictive model, prepare to get sidelined.

Aviation Signals Something Bigger

While most industries are shrinking, airlines are quietly ramping back up.

United is clearing out CJO backlogs and preparing for a massive pilot surge within 60 days.

American Airlines confirmed 568 pilot hires in 2025 with a target of 1,500.

And yet…

Swiss Airlines canceled 1,400 flights for summer.

Not because of strikes or budget issues.

Because staff had accidents, got pregnant, or forgot that training takes time.

This is why your talent strategy can’t be built on hypotheticals.

If it doesn’t account for life, it’s not a strategy.

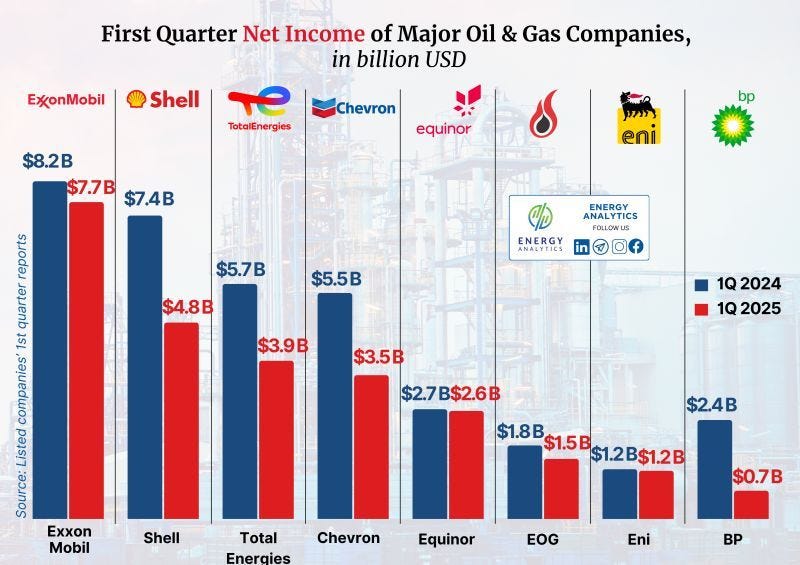

Oil Just Hit Its Breaking Point

From Grey Hair Ops Guy:

My own rig got dropped. Five years of post-COVID rebuild. Gone.

Why?

We need $65/barrel to survive. It fell short.

ALSO

Phillips 66 layoffs weren’t new. But now it’s real:

600 employees and 300 contractors affected

L.A. refinery closure by late 2025

Meanwhile, midstream consolidation chatter is heating up.

Whispers of new M&A moves coming.

Margins are thin. Time is tighter.

Layoffs Are Happening in Slow Motion

Kraft Heinz:

$2.4M in stock sold by CEO & CFO (March)

4 board members took exit-vesting grants

200+ headcount gone under the radar

Hiring is flatlined in Ops, Sales, Support

No WARNs filed yet

My S3 Layoff Risk Model?

10/10 risk score for Q2. Want more? Let’s talk.

JPMorgan:

Hiring down 88% since January

Interns nearly wiped out

Ops roles cut

CFO Jeremy Barnum says: “At the margin, we’re resisting headcount growth.”

Translation: If you’re not client-facing, don’t get comfortable.

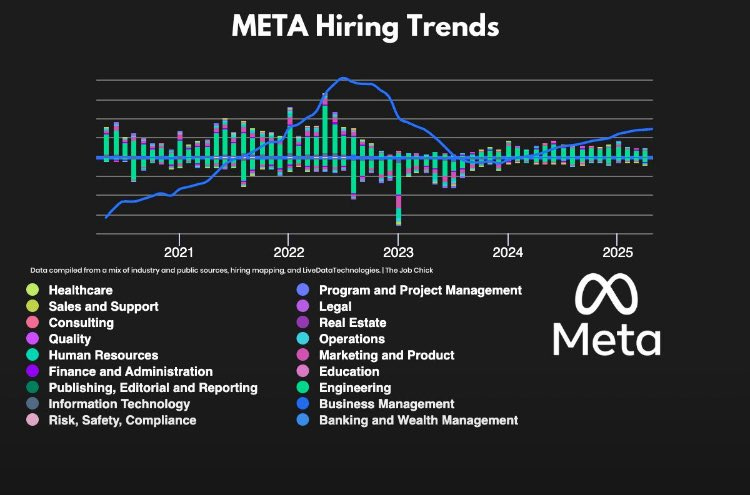

Meta: Not layoffs, just forced exits.

Starting June 16, 15–20% of employees must be rated “below expectations.”

That’s up from 12–15%.

Managers are expected to “make exit decisions” but avoid company-wide terminations.

You catching that?

Here’s What I’m Watching THIS WEEK.

Rule 1033 - the CFPB’s open banking framework - could be toast Friday.

If it does, so does:

Mandated data-sharing

Bank/FinTech integration

Consumer ownership of financial data

This will impact hiring in FinTech. Open roles will collapse inward. Workforce Intelligence Mapping captures those early pivots.

Consumers are about to lose control of their financial data- AGAIN- and no one’s asking their permission.

I agree to the Terms & Conditions

I've read the Privacy Policy

I understand none of this means I actually own my data

Watching the 1033 on Friday… and wondering how many people still believe their privacy settings mean anything.

The Job Chick's Insider Edge is a reader-supported publication and I love ya’ll to bits. Get more new posts and support my work.

Student loan garnishments resume.

$100M already clawed back

Tax returns, gone

15% of paychecks next

Linda McMahon confirmed it. You’re not imagining it.

Airlines hiring again.

United & American leading the surge

Pilot flow agreements driving momentum

Reversals like this = movement, promotion, opportunity

The Exxon/Chevron arbitration over Hess kicks off May 26

Meanwhile, insiders say integration plans are full steam ahead.

Final Word:

This isn’t just about job cuts. It’s about how the entire system is being rewired.

Workforce dynamics are changing.

Hiring isn’t broken because of tariffs or politics. It’s broken because the infrastructure and tools used to hire haven’t evolved with reality.

You’re being scored by algorithms that HR teams don’t even trust.

People are living paycheck to paycheck - even those earning six figures.

62% of Americans, according to PYMTS and LendingClub.

Even a Chime exec I spoke to agree: 1/3 of their users can’t make it. 1/3 barely can.

This is the backdrop of every hiring decision, every promotion freeze, every stealth layoff.

If you think your job is safe, if you think your industry is immune… you’re not paying attention.

I am.

Stay sharp,

Amanda Goodall, The Job Chick

CEO, EdgePulse

I am new here, senior citizen, interested in what you write about. Thank you for writing about this, I am shocked how little it is discussed by the media. I keep getting the feeling something is seriously either happening or going to happen to our economy. So much is unreported. So, thank you.