JPMorgan’s 88% Hiring Drop Is the Loudest Quiet Signal on Wall Street

Here’s what investors need to watch before Q2 earnings land.

By now, we all know JPMorgan doesn’t flinch unless it has to. So when their hiring levels start to fall off a cliff - down 88% since January - you’d better believe it’s not just a hiring blip.

So here we are.

If you’re an investor, exec, or just trying to stay one step ahead of the next quarter’s mess - ya’ll better start watching the labor signals before the earnings calls and it’s not just about the fact they already stated early this year they were cutting jobs during several months… it’s SO, SO, SO much more.

The Data Wall Street Shouldn’t Ignore

Let’s start with the receipts:

January 2025: ~770 new hires

May 2025: Under 90

That’s a full-blown 88% hiring collapse in five months

Interns? Gone.

Staff hires? REALLY dropped off.

VPs and Consultants? Quietly phased down.

Hiring isn’t slowing - it’s being surgically shut off.

It’s intentional. They know what they are doing.

The CFO Translation Layer

CFO Jeremy Barnum wasn’t exactly subtle at JPMorgan’s Investor Day:

“At the margin, we’re asking people to resist headcount growth…”

Translation:

“Don’t ask for budget. Don’t hire. Stretch your people. And pretend it’s strategy.”

Unless you’re in a high-certainty role (think advisors, bankers, client-facing revenue roles), you’re either working harder or watching your job disappear behind a machine. So yeah, my advice as someone who has watched this company hire and freeze for 20+ years… Don’t apply unless you have a straight in or you are in these types of roles. Save yourself time and a heartbreak.

AI’s Not Coming. It’s Already Here.

Marianne Lake (CEO of Consumer & Community Banking) came with her own friendly nuke:

10% of operations employees cut

AI to “deliver more with less”

I mean - ouch…. harsh… but needed. Fraud, statements, account services - all getting an upgrade via algorithm - no humans needed.

But here’s what most peeps are missing:

This isn’t a pilot program.

It’s a full-scale replacement plan.

Engineers aren’t safe either. Even coders are using AI tools to cut their own keystrokes.

As Barnum put it:

“It’s not just the amateurs who are helped by these tools…”

Welcome to the era of self-disruption, where even top talent is automating themselves out of the headcount spreadsheet.

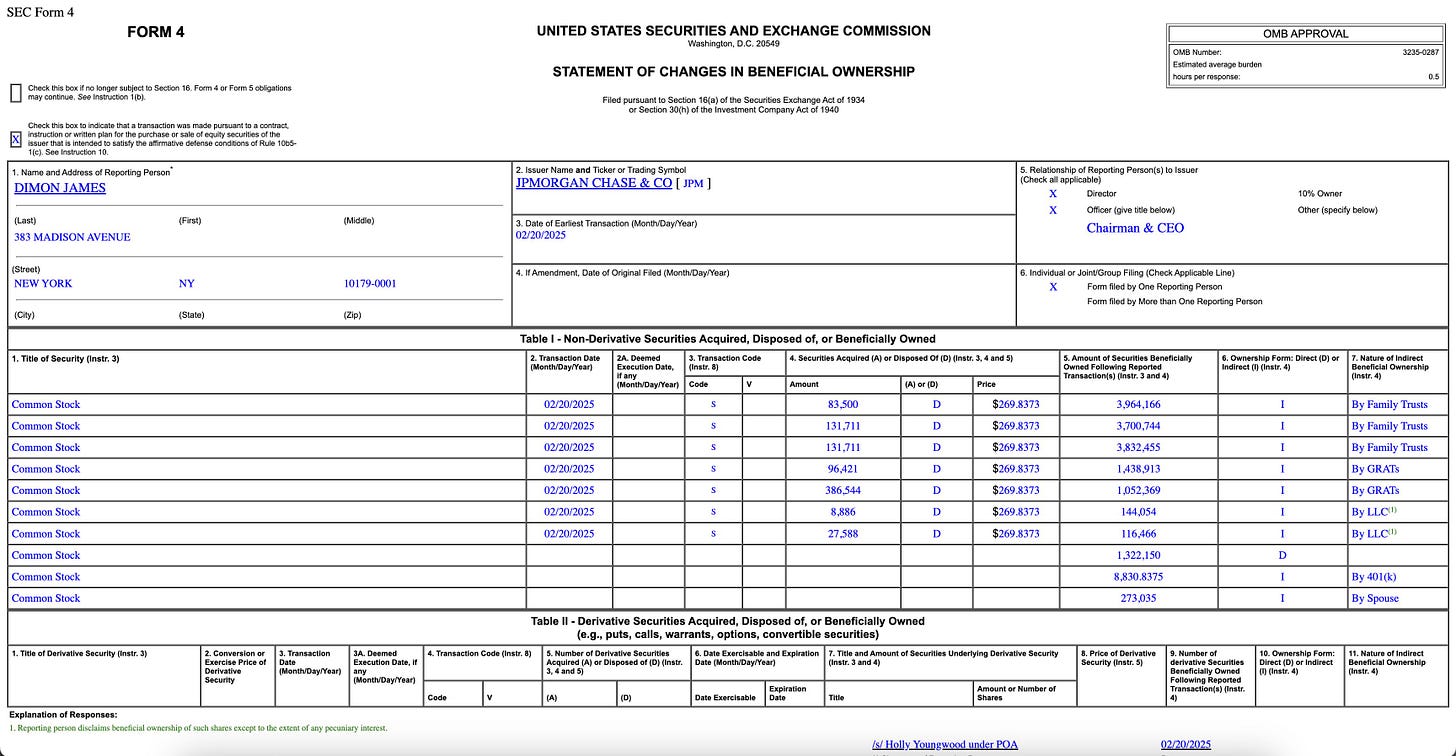

Remember when everyone lost their mind over Jamie Dimon selling shares in early 2025?

Jamie Dimon’s $233M stock sale wasn’t random at all. It was pre-planned under a Rule 10b5-1 plan adopted on 11/7/2024, and disclosed in January 2025.

He sold 1M shares through August... however, I'd like to talk timing.

JPM knew layoffs were coming when this plan was filed. Workforce reductions aren’t last-minute decisions.

What stood out to me in all of this when I look at hiring trends: JPM didn’t staff up HR ahead of these cuts.

There was no surge in late 2024 or early 2025. If they were preparing for mass layoffs, we’d see an HR hiring bump, but it didn’t happen. Yes, that means that HR departures are steady (have been the past several years) and that they’re handling workforce reductions with the existing team

AKA - JP Morgan is keeping it pretty lean.

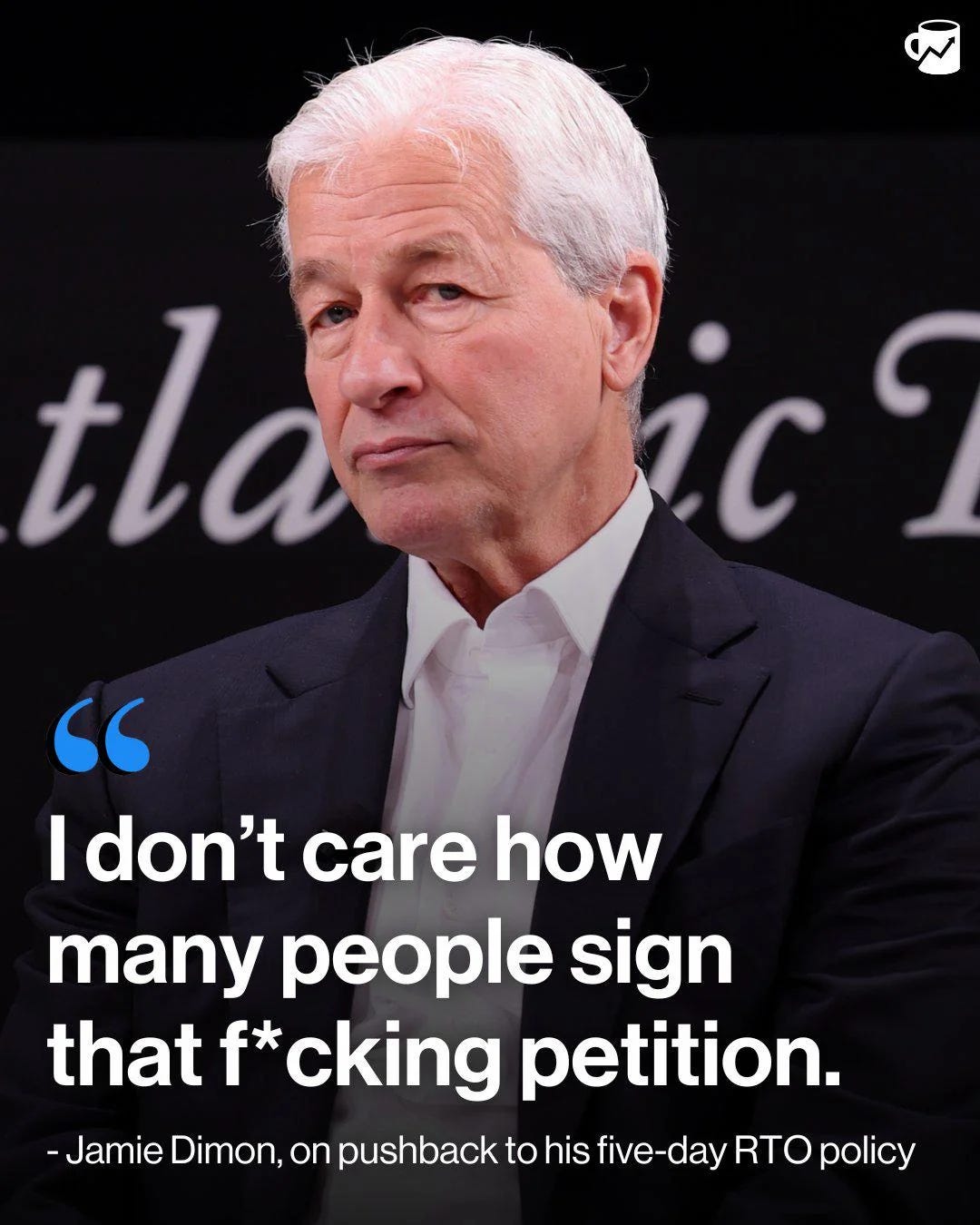

What this sounds like is that instead of bulk layoffs, they’re relying on RTO mandates to force voluntary attrition. So back to the stock sells - Look, it’s not illegal, it’s just suspish timing. Layoffs weren’t done, and March/April brought more.

What Investors Need to Clock - Right Now

Let’s not get cute. If you’ve got JPMorgan on your watchlist (or any of its mid-cap cousins), this is your early warning system going off. You’re welcome. Now read below:

Efficiency > Expansion

JPMorgan’s hiring freeze isn’t panic - it’s prep. Period. Mic Drop.

They’re bracing.

For what?

Could be slower loan growth.

Could be cautious consumers.

Could be softness in wealth management or underwriting.

Likely it’s D, all of the above.

You don’t shut down 88% of hiring in a bull cycle.

You do it when you expect turbulence.

And when JPM leans back like this, expect everyone else to follow.

AI = Margin Levers, Not a Gimmick

Here’s where it gets spicy. JPM isn’t just saying “we’re cutting costs.” They’re saying:

“We’ll still hit margins - just without the humans.”

AI’s not theoretical anymore.

It’s directly replacing 10%+ of functional roles. That means less bloat, faster output, and theoretically - better ROE.

Investors? I know you love this…well, until someone misses revenue and can’t blame it on “expansion costs.”

Labor Data = The Canary in the Financial Coal Mine

The chart above isn’t about JPM hiring fewer interns.

It’s your macro early indicator for Q2 and Q3. Again this isn’t just about their preannounced layoffs for 2025….

Labor data leads revenue data. Every time. Ya know how I always say Talent is the New Alpha… I’m sooooo not kidding ya’ll. Some people read horoscopes. I read the job market.

When hiring tanks, so does demand for workspace, SaaS, B2B vendors

Watch fintech, HR tech, and middle-market banks they follow the big guys’ shadow

Expect softer earnings guides, margin obsession, and tighter hiring across the board

Ya’ll, this is the part of the movie where the music drops and the smart money leaves early.

In fact…. check this out.

Bonus Red Flags Worth Keeping on Your Radar

JPM headcount has been slipping month over month since February

$95B in total spend - but zero appetite for expansionary headcount

IRS is cutting 70,000 jobs with AI.

IBM already swapped hundreds of HR workers for automation

Everyone’s smiling in press releases, and their glowy Q1 earnings (don’t get me started on these fake results) but the layoffs are quietly stacking.

This is the 2025 playbook.

Final Word: Don’t Mistake Silence for Stability

What JPMorgan just signaled to the market isn’t loud - but it’s seismic.

They are rebalancing the entire org around efficiency, not growth.

For investors: this is a bet on margin strength, not top-line surprise.

For analysts: watch AI productivity vs. client satisfaction

For employees: tighten your laces - if your job isn’t tied to revenue, it’s on review

Wall Street loves a lean machine. Until that machine misses a beat. Q3?

If you want more labor-driven analysis before the rest of the market catches on, subscribe. I’ll show you what’s happening behind the hiring headlines - before the stock reacts.

Because ya’ll… the labor market never lies and Talent is the New Alpha.

—- Amanda Goodall, The Job Chick

Get in touch for career help or Workforce intelligence you can’t find anywhere else.