Wall Street's gaze fixates firmly on Halliburton's latest earnings announcement. Yet, while investors dissect EPS and revenue numbers, another quieter but potentially far more consequential storyline unfolds behind the scenes: the subtle yet unmistakable signal of insider trading patterns and workforce dynamics.

Halliburton’s Q1 Earnings

This morning, Halliburton’s earnings were reported, revealing:

•Net income of $0.24 per diluted share.

•Adjusted net income per diluted share1 of $0.60.

•Revenue of $5.4 billion and operating margin of 8%.

•Adjusted operating margin2 of 14.5%.

•Approximately $250 million of share repurchases.

The movement of key executives and internal signals paint another - one that traders, investors, and hedge funds might overlook.

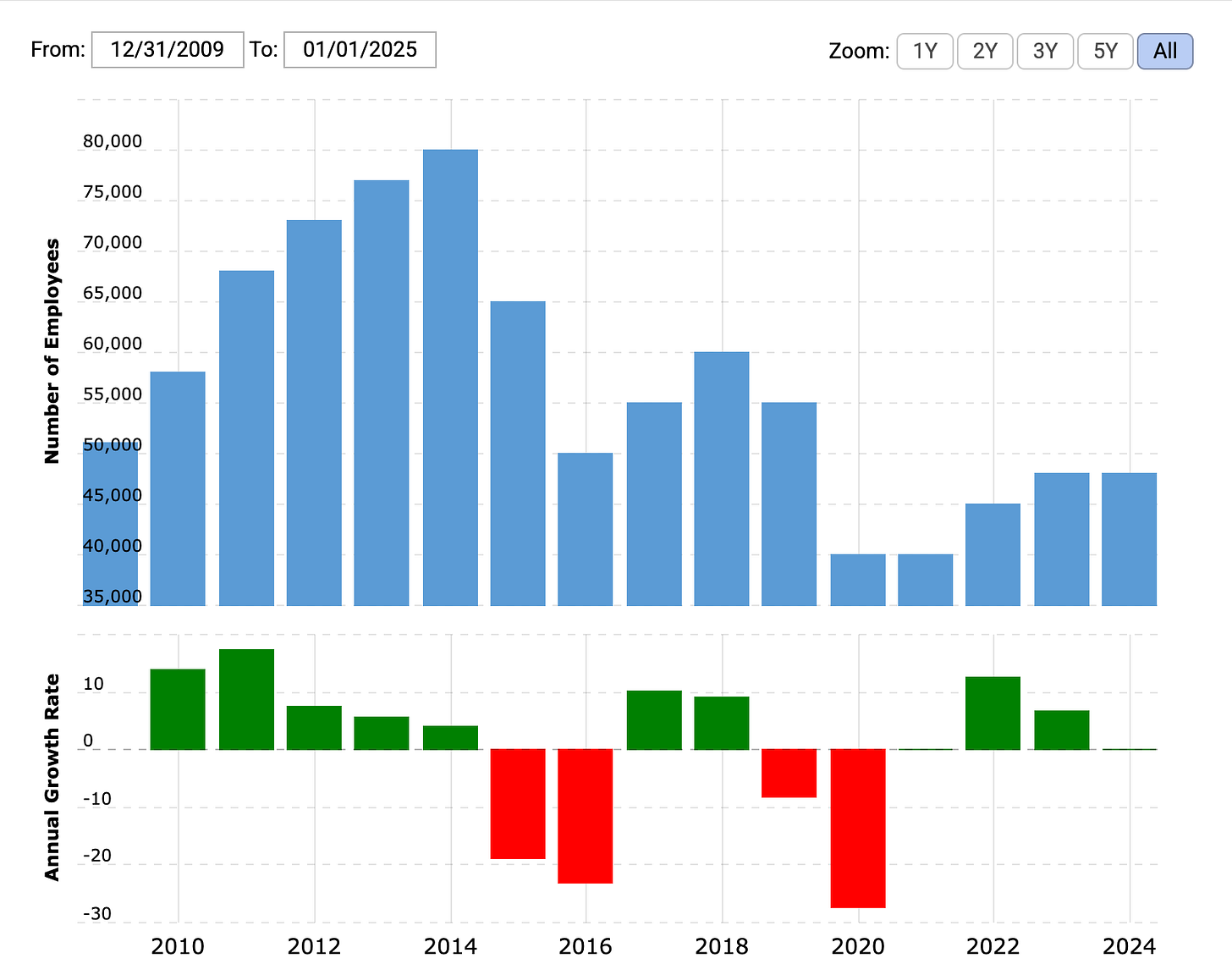

Historically, Halliburton - and most energy sector giants - often deal with their workforce changes indirectly.

It's subtle, hidden in plain sight through executive stock trades and quiet shifts in HR and operational leadership.

This has been tracked, empirically validated on our own model we've named Sequence 48 - an indicator that turned "red zone" just days before today's earnings call.

What is Sequence 48 (S48)?

Sequence 48 is The Job Chick / EdgePulse’s predictive signal derived from analyzing thousands of historical trading events in relation to subsequent workforce reductions (RIFs). S48 pinpoints a highly predictive window - typically weeks ahead of public announcements - when layoffs are imminent.

Last night, Halliburton's S48 indicator spiked - a significant move signaling elevated risk of workforce cuts.

Why Investors Trust EdgePulse & Sequence 48

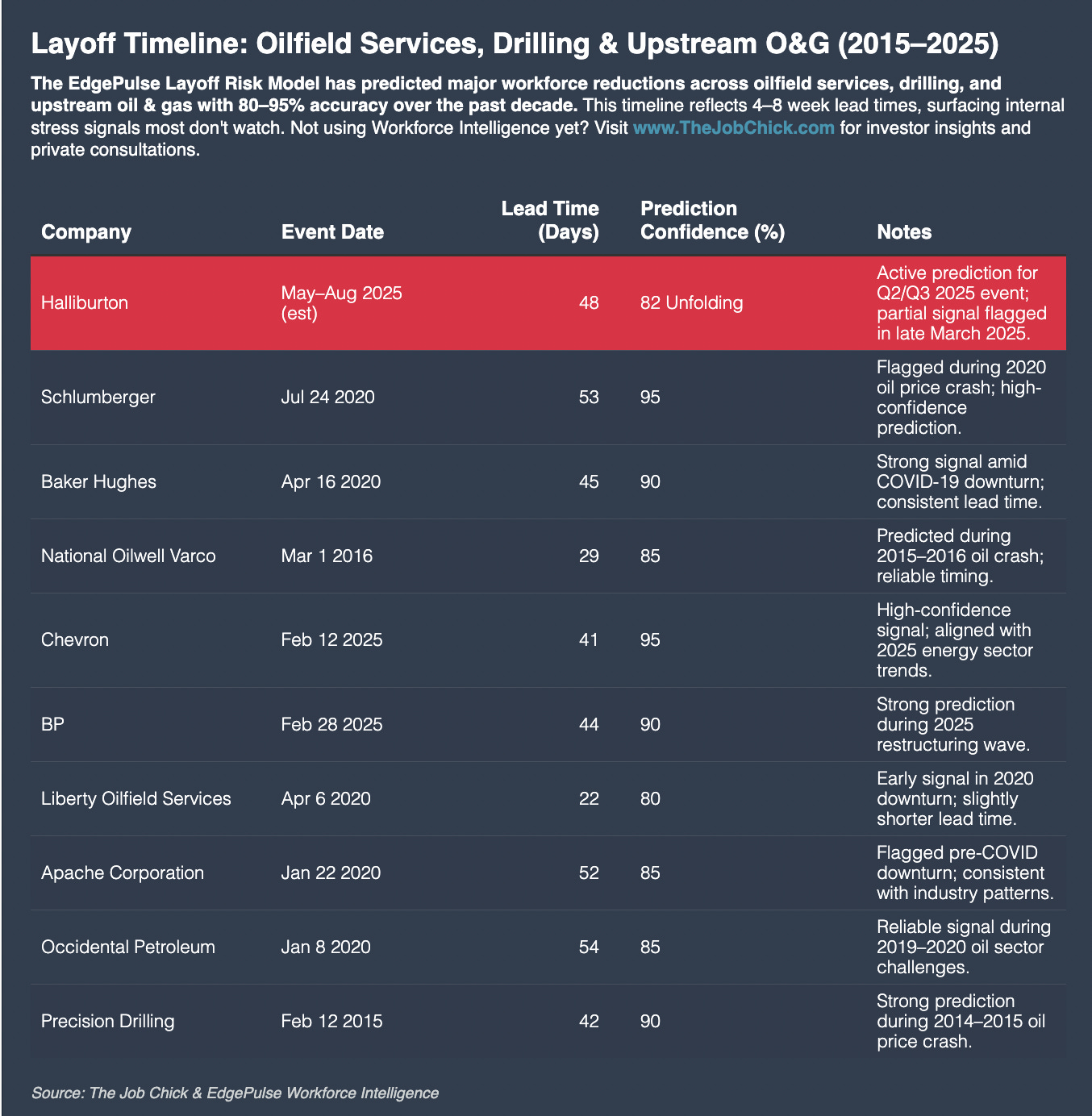

The Sequence 48 Indicator has successfully flagged workforce actions for numerous major industry players, including Chevron, Schlumberger, Baker Hughes, and Occidental.

Examples from our historical database:

Schlumberger (2020): 129-day lead from initial exec signals to workforce announcement.

Baker Hughes (2020): 46-day predictive lead.

National Oilwell Varco (2016): 46-day predictive lead.

Occidental (2020): 68-day predictive lead.

These represent carefully validated, data-driven patterns that give investors and institutional investors a critical edge.

If you are looking for long term signals and reports, reach out.

Let's examine why the S48 Indicator flashed specifically for Halliburton:

Financial Underperformance and Margin Compression:

Halliburton’s recent financial disclosures revealed margin pressures with North American revenue declining notably - down 9% in Q4 2024, with a continuing "flat-to-lower" outlook. Historically, Halliburton responds swiftly with workforce adjustments when facing similar financial headwinds.Executive Stock Activity:

In early March 2025, CFO Eric Carre executed significant share sales via a 10b5-1 plan, alongside other key operational executives. While routine, such sales have historically correlated closely with subsequent cost reduction measures.Industry Headwinds:

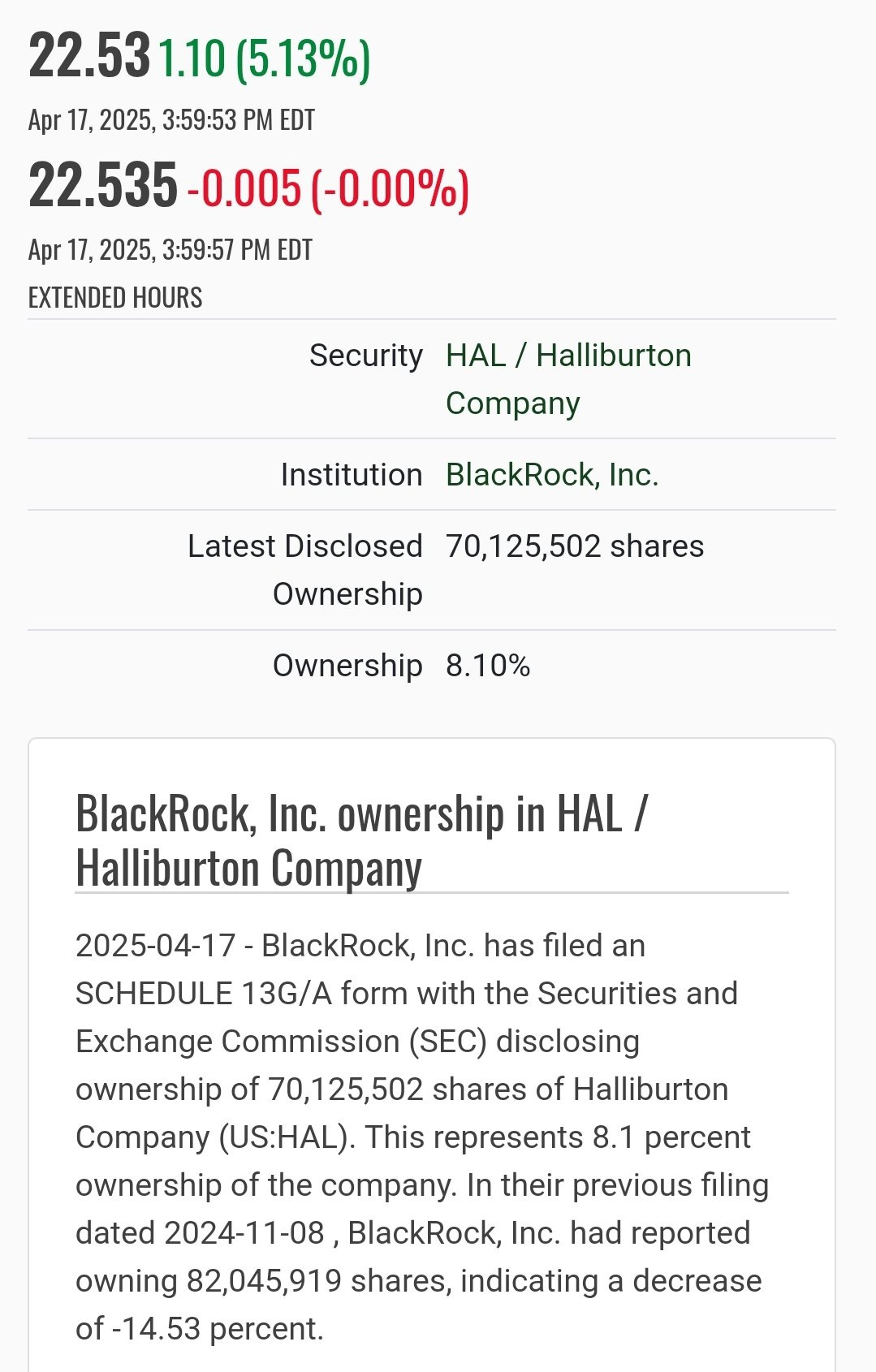

With oil prices declining and rig counts falling, the fundamental environment demands cost adjustments. Halliburton historically matches rig reductions with direct and indirect job cuts to maintain profitability.Institutional Signals:

BlackRock - one of Halliburton’s largest institutional shareholders - recently reduced its stake by approximately 14%. Institutional exits often presage operational adjustments, underscoring market caution.

Our Projections: Workforce Impact and Timelines

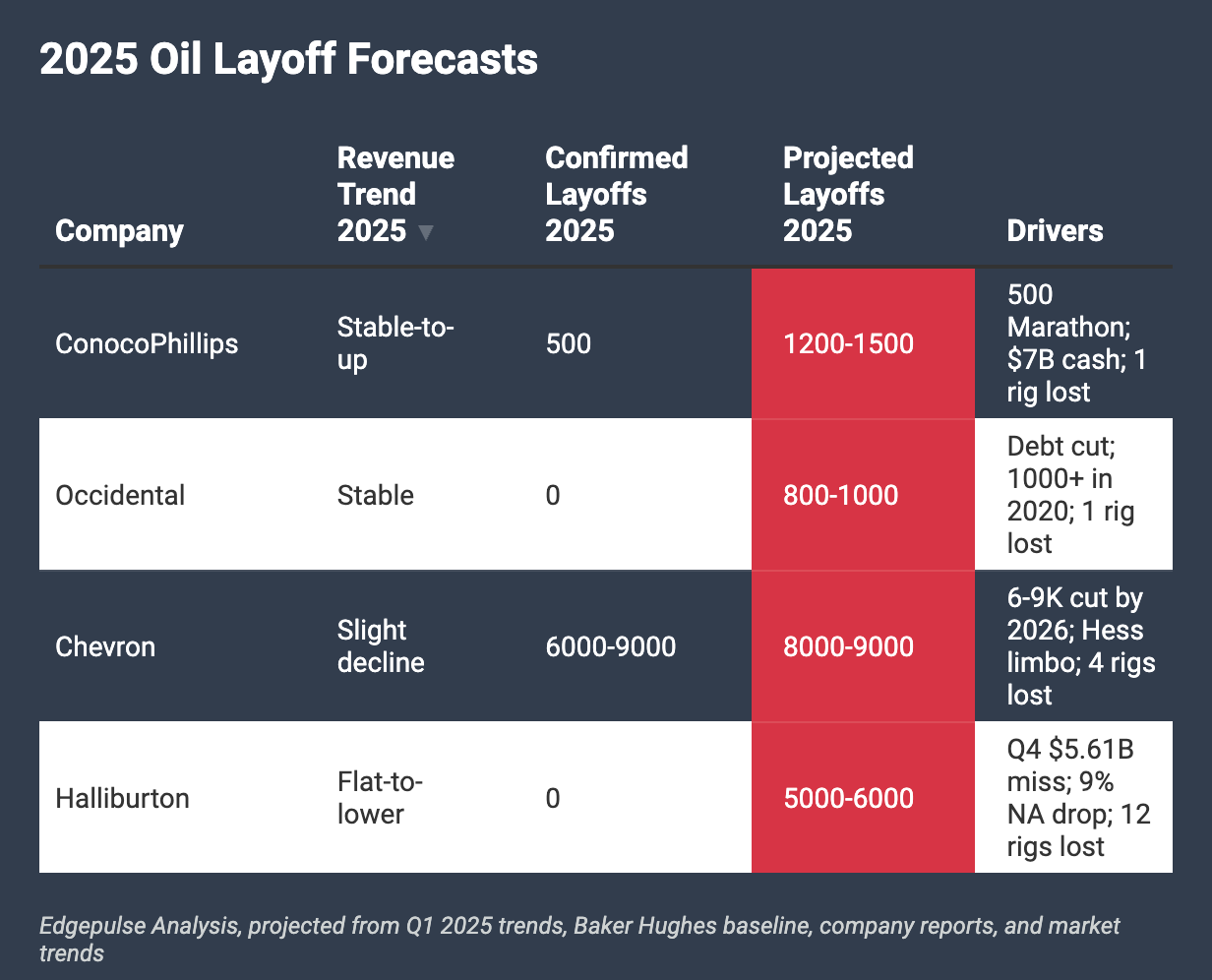

Using The Job Chick / EdgePulse’s proprietary headcount-versus-profitability models alongside the S48 indicator, we project significant layoffs for Halliburton in Q2–Q3 2025:

Projected Layoffs: Approximately 3,500 - 5,000 positions (roughly 8%–10% of the estimated current workforce).

Timing: Initial workforce reduction announcements are likely within the next 45–60 days based on historical timing linked to similar past signals.

In their Q1 2025 earnings:

Halliburton reported a significant one-time restructuring charge totaling $356 million, detailing:

$107 million directly for severance costs (employee layoffs).

$104 million for impairment related to assets held for sale (equipment/assets disposal).

$53 million for real estate facility impairments (facility closures or consolidations).

The $107 million severance charge directly implies planned or recently executed layoffs, making this number the most precise indicator of imminent workforce reductions. **This figure was confirmed on the Q1 earnings call, with CEO Eric Carre noting severance costs were recognized this quarter - meaning layoffs are already underway.

Severance Math Doesn’t Lie

Halliburton disclosed $107 million in severance in its latest earnings (likely underway).

Here’s what that number tells us:

Low estimate ($20K/employee): 5,350 layoffs

Mid-range ($40K/employee): 2,675 layoffs

High-end ($60K/employee): 1,783 layoffs

Anywhere you slice it, we’re looking at thousands of roles impacted.

But the Real Story Is in the Other $249M

Halliburton’s total restructuring charge hit $356 million, with only $107M tied to severance. So what’s the rest?

$104M in asset impairment = gear coming off the field - think tools, trucks, maybe entire spreads. You don’t sell gear unless you’re cutting ops.

$53M in facility write-downs = closed yards, shuttered offices, regional exits. Major footprint reduction.

Combined? It’s a quiet admission: this is bigger than a severance round.

Real-World Halliburton Layoff Estimate (Q2–Q3 2025)

When you stack direct severance with indirect ops shrinkage, you get a clearer picture:

Direct layoffs (from severance): 2,700–3,500

Additional, indirect impact (closures, asset sales): 1,000–2,000

Total at-risk roles: ~3,700–5,500 in Q2–Q3

Patch logic confirms it:

12 rigs offline = ~960–1,500 direct jobs gone

Add secondary services (×1.5) = ~1,440–2,250 total jobs impacted

That’s just rigs. Add in real estate and gear and you’re well into multi-thousand territory.

How to Trade This

Short-term: Expect selling pressure once the headlines catch up to what the earnings already revealed.

Mid-term: Watch for ESG screens and institutional reallocations.

Long-term: Track pivot signals - AI, automation, and restructuring trends that define who survives the downcycle. Stick with me- I’ll keep you updated.

Talent is the New Alpha

The Street will digest Halliburton’s earnings through traditional financial metrics - but smart money understands the BIG truth: workforce trends offer alpha.

EdgePulse’s Sequence 48 Indicator has delivered an actionable, accurate early-warning system. The silence from HR and legal insiders right now is a timer counting down. This is just one part of what we offer to the best of the best.

Talent signals profitability.

Workforce decisions shape stock performance.

The Sequence 48 Indicator has spoken, and Halliburton's workforce story is just getting started.