Goldman Sachs Headcount Cuts, Buybacks & EPS Growth - What the Market’s Missing

If GS Drops Below 28% Comp Ratio, MD/VP Exits Could Spike. Is This the Breaking Point?

Let’s start this off by stating: If GS goes below 28% comp ratio, history suggests high-value MD/VP exits spike within 6 months.

𝗚𝗼𝗹𝗱𝗺𝗮𝗻 𝗦𝗮𝗰𝗵𝘀 𝗶𝘀 𝗿𝗲𝘀𝘁𝗿𝘂𝗰𝘁𝘂𝗿𝗶𝗻𝗴. That VP exodus was the warning.

The layoff announcement the other day was only a small part of this. They’re moving the entire cost structure. Bloomberg reported that GS is steering employees to Dallas and Salt Lake City with a “part request, part ultimatum.”

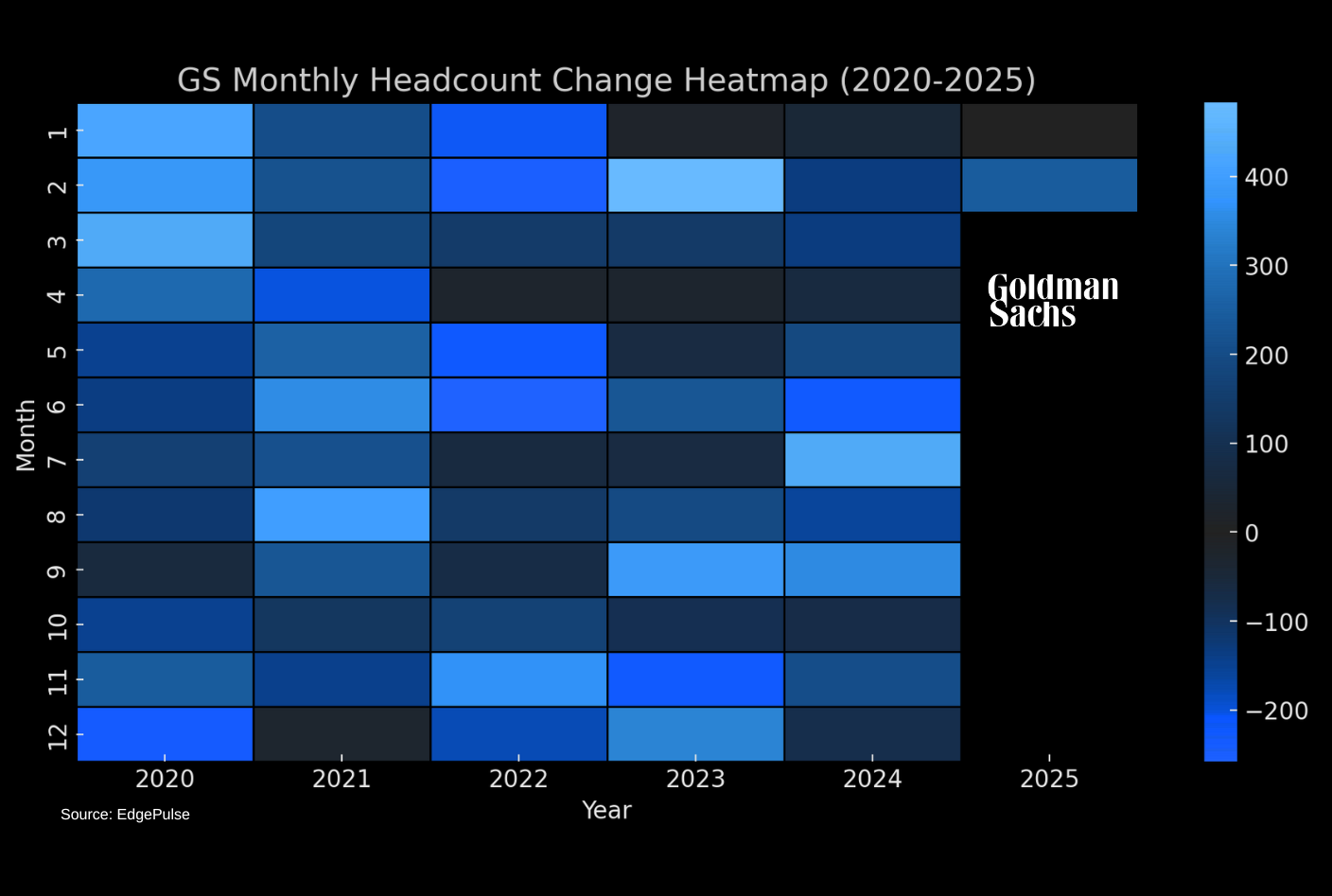

To put this into perspective- an already REALLY lean organization is really going to have more cuts (2250) in the month of MAY 2025- than they did during covid? Hmmmmm.

If you are trading the EPS print on it all... You should know this:

▪️ Warsaw, Birmingham, and Bengaluru are growing.

▪️ VPs are getting cut.

▪️ Senior Relationship Advisors are moving up.

▪️ IB hiring remains - but only in M&A and volatility desks.

▪️ They see something breaking faster than expected.

So let’s break it down a bit.

Goldman Sachs 3-5% cuts?

They are moving up their SRA and dropping Veeps?

Shocked.

So let’s say Goldman Sachs’s annual SRA cull happens in May. What does that tell us?

It means Goldman is reacting to conditions changing faster than expected. And if one of the biggest institutional players in the market is getting out ahead of something, that should scare you.

Repeat after me…. layoffs aren’t just corporate adjustments - they’re massive economic signals. And when a bank that thrives on high-risk, high-reward plays starts slashing headcount at an unusual time, it’s a signal that conditions are worse than they’re publicly admitting.

Goldman has been aggressively managing its workforce while throwing billions into buybacks - and the numbers reveal something the market isn’t pricing in.

Headcount Shrinkage vs. EPS Growth

Q1 2025: GS headcount at 46,300, down from 46,500 in Q4.

Q1 2024 vs. Q1 2025: -200 net headcount reduction, but EPS is up at $11.2

Buybacks? GS is still spending $1.7B per quarter to prop up shares.

Compensation Ratios

GS 2023: 32% of revenue to comp.

Q4 2024: 29.5% (cutting deeper).

2025 Estimate? If buybacks keep the multiple afloat, does comp drop below 28%?

This is THE trade-off:

Squeeze comp, boost EPS

Squeeze too much, lose top talent to private markets

The May SRA Cull → The Real Inflection Point

May’s rumored round breaks precedent - a potential double dip in the culling cycle. When does retention risk start outweighing EPS expansion?

Is GS’s comp tightening sustainable, or are they walking the same line that led to the 2017-2019 exodus?

This is the critical hedge:

More buybacks → EPS support

Comp cuts → margin expansion

But talent loss → weaker deal flow & lower LT profitability

Key Risk to Watch:

If GS goes below 28% comp ratio, history suggests high-value MD/VP exits spike within 6 months.

2025 Exp. 1,550 layoffs - May 400 Fixed Income +, Sep 275 Operations, Nov 275 Consumer.....

THEN came the announcement I mentioned above for the SRA cull in May. Did I mention how shocked I am?

VP hiring and exits at GS have been in a clear, volatile cycle since 2020. But something changed after mid-2023.

➡️ No strong recovery in VP hiring.

➡️ More exits than replacements.

➡️ Hiring has flatlined into 2024.

The shift away from NYC and London into Dallas and Salt Lake City was already in motion too. They’re gutting expensive VP roles and shifting talent into lower-cost markets. VERY telling.

Current Estimate for 2025

• Layoffs: ~1,650 - 2,250 (depending on final % cut)

• Cost Savings: $320M - $435M

• EPS Lift: $0.55 - $0.70+

• IB hiring impact remains: +400, driven by M&A/volatility

Dallas & SLC are the cost efficiency engine - super important after their failing efficiency inversion stats.

Look, I’ve been stress-testing my 2025 GS layoff and hiring projections for months. And nowhere, nowhere, did May look like a real cut month. Not in the models. Not in the historical cycles.

Not in Goldman’s behavior. Yeah, ofcourse we have to assume market moves - But that is only possible within stress tests. Which, yea, I also run, including 10,000 simulations. It flashed but not a typical dataset.

If GS is forcing high-cost talent out while expanding low-cost locations, this is no longer about normal hiring cycles. Yes, ya'll... this is about front-running economic turbulence. The market should have seen this months ago. Did you?

Goldman is being smart and positioning before the wave hits. Yeah, that one.