When Yahoo Finance put my original thesis on the ticker page for DAL 0.00%↑ on July 7, I framed Delta not as a clean earnings story, but as a company running one of the most calculated workforce experiments in aviation.

https://finance.yahoo.com/quote/DAL/

Delta was suppressing growth signals, tightening its labor core, and leaning into attrition as a margin weapon.

Three days later? $DAL touched $56, up +12%, hitting my call almost to the dollar.

Today’s Q2 earnings confirmed what I outlined then:

The Thesis (as posted July 7 - unchanged)

Delta Air Lines: Leaner Workforce, Stronger Margins…But Is It Sustainable?

$DAL Delta’s Q2 print may look clean, but the airline’s labor model is carrying the load, and it’s getting heavier. Marking its 100th anniversary, Delta’s January 2025 keynote positioned the airline’s long-term vision squarely centered on premium customer experiences rather than network growth.

The market is rewarding Delta’s margin discipline and summer strength, but under the hood, I’m seeing structural constraints that I’m not quite sure are priced in. The real alpha isn’t in projecting revenue per seat mile (RASM). It’s in understanding how Delta is manipulating labor leverage, suppressing operational headcount, and buying time before the labor bill comes due.

Delta previously cut Q1 guidance. Consumer & corporate spending “started to stall.” Stock tanked 13% after hours. Ed Bastian told us at CES. We just had to listen. From CES keynote transcript: “Today, you expect travel that feels tailored to you… the goal is a seamless, connected experience from start to finish.” The money was always in premium.

Delta has risen 36% over the past three months, driven by easing tariff fears, record TSA volumes, and high-margin international demand. Analyst sentiment is bullish, with price targets clustering around $56–$63.

But zoom out: the stock is still down 15% YTD. It’s trading at 8.9x earnings with a PEG ratio north of 39. The market is saying: “We like your margins, but we don’t trust your growth.”

And that’s where the workforce story begins. This is what I focus on the most because talent is the new alpha.

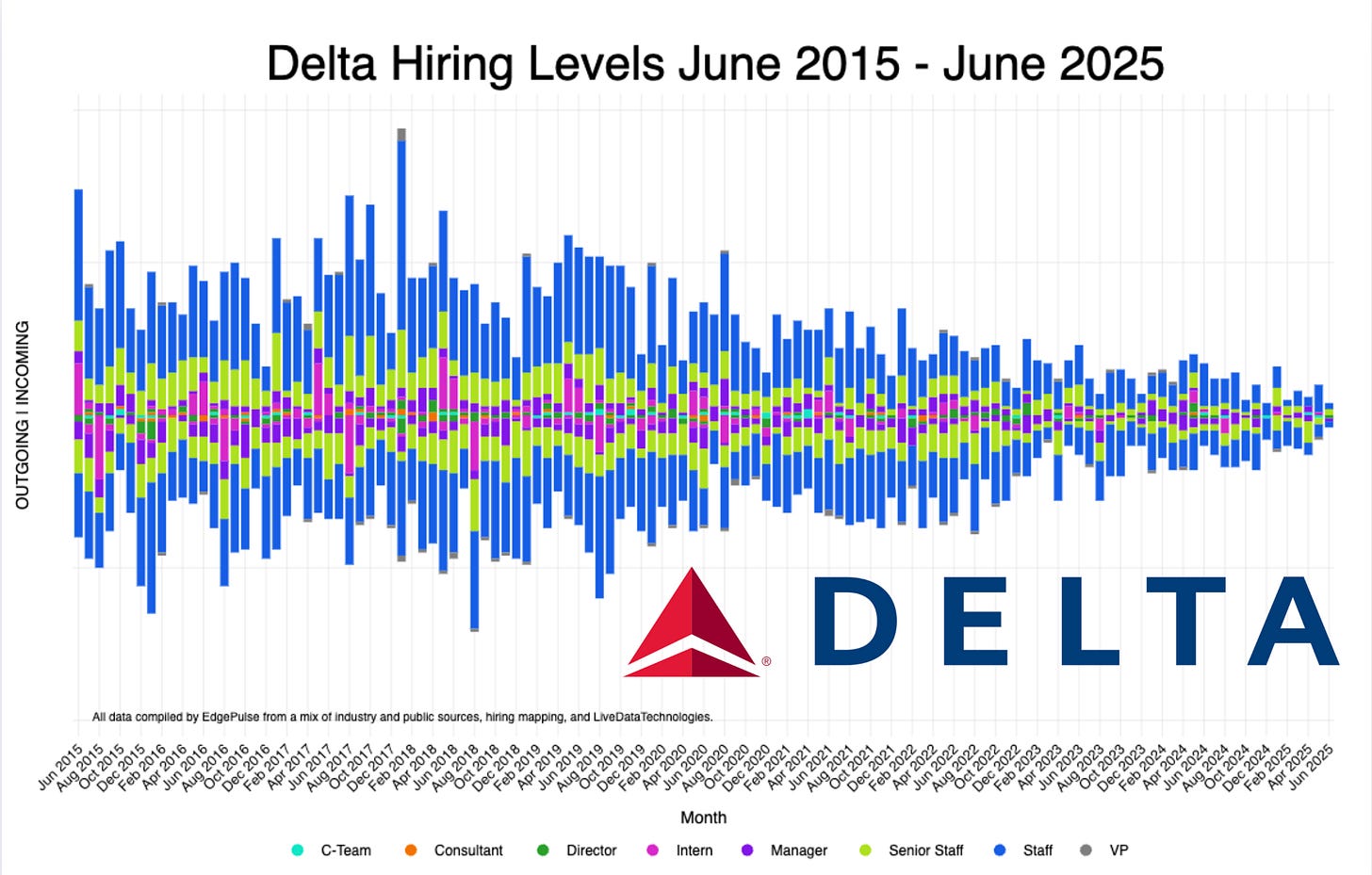

Internally, Delta is playing one of the tightest labor games in the airline industry.

Flat-to-declining role headcounts across customer experience, ramp agents, and ticketing roles.

Nearly zero growth in operational tech roles, particularly in scheduling, load optimization, and maintenance coordination.

Heavy reliance on subsidiaries (Endeavor Air, Monroe Energy, DAL Tech) to contain wage pressure and keep headcount off mainline books.

Delta is not hiring for growth. For now, it’s a smart play.

Fewer employees are producing more revenue per head.

Margins are healthy because costs are structurally capped.

But role fatigue, wage compression, and union risk are compounding.

Most of the operational strain is concentrated in non-union, customer-facing roles, which yes, you guessed it, is the very segment driving 40% of revenue. The company can’t scale this team quickly without undermining margin.

Summer travel demand is pressing harder than ever. TSA just logged two of its busiest days in history, but we’ve seen no commensurate lift in hiring or workforce flexibility.

If Delta announced a re-acceleration in hiring, or even internal job postings for frontline ops, the market would interpret that as confidence in long-term demand. But that’s not what we’re getting.

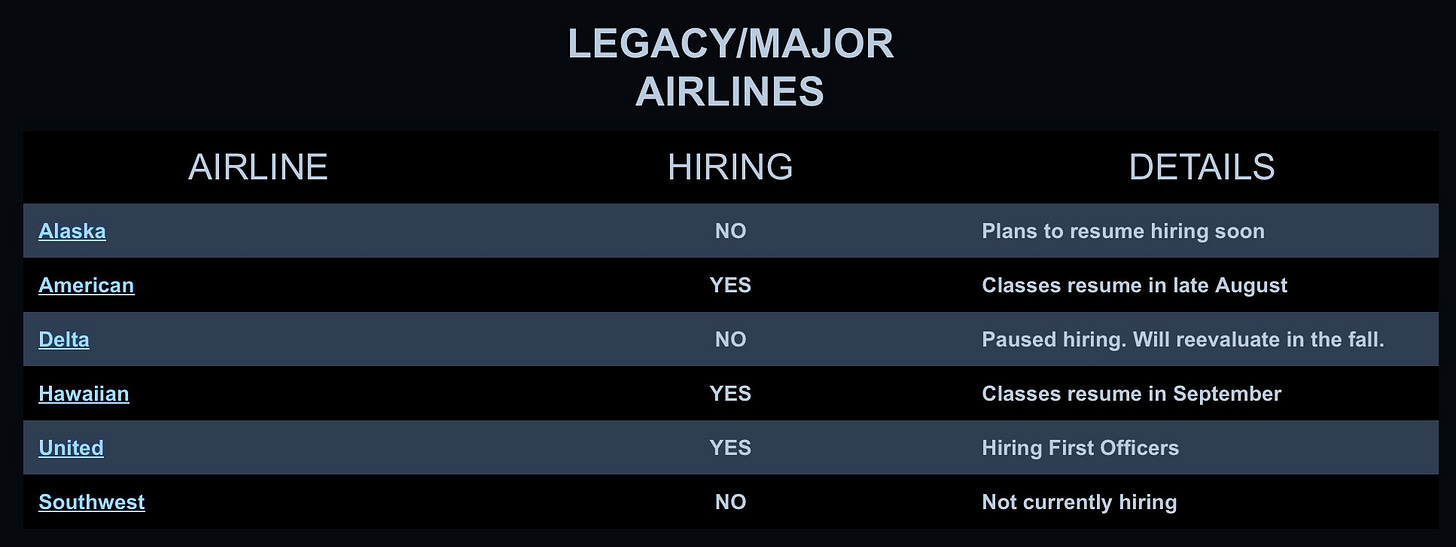

Inside the cockpit, it’s the same story: Delta isn’t adding real pilot headcount.

They’re delaying real upgrades and minimizing new hire training exposure, which suggests they’re still in defense mode, not growth mode.

Even qualified internal pilots are being partially upgraded (only on fly months), without full compensation or reclassification, which is a cost-control signal.

Movement in the SLI pool may be a precursor to fall/winter realignment, but not a guarantee of fleet upgrades or new pilot onboarding.

The late-June Atlanta storm revealed just how tight Delta’s labor model truly is. With over 100 aircraft requiring damage inspections and no scalable response bench in place, the event has tested the cost containment strategy, questions Q2 margins, and previews what Q3 could look like under sustained pressure. If traffic surges beyond plan, Delta risks service degradation and unplanned labor spikes that pressure Q3 and Q4 earnings.

Delta has mastered the art of doing more with less, but without reinvestment in its own labor pipeline, any shock, from tariffs to tropical storms, could turn lean ops into operational risk.

Q2 will likely beat. The question is how long Delta can defer labor rebalancing. While near-term earnings strength may support a move toward $56–58, I believe structural labor rigidity caps upside beyond that. Any signs of Q3 softness or delayed hiring could send the stock back toward the low $50s by fall.