BP’s 2025 hiring strategy in one sentence.

If your job doesn’t make them money, they don’t need you.

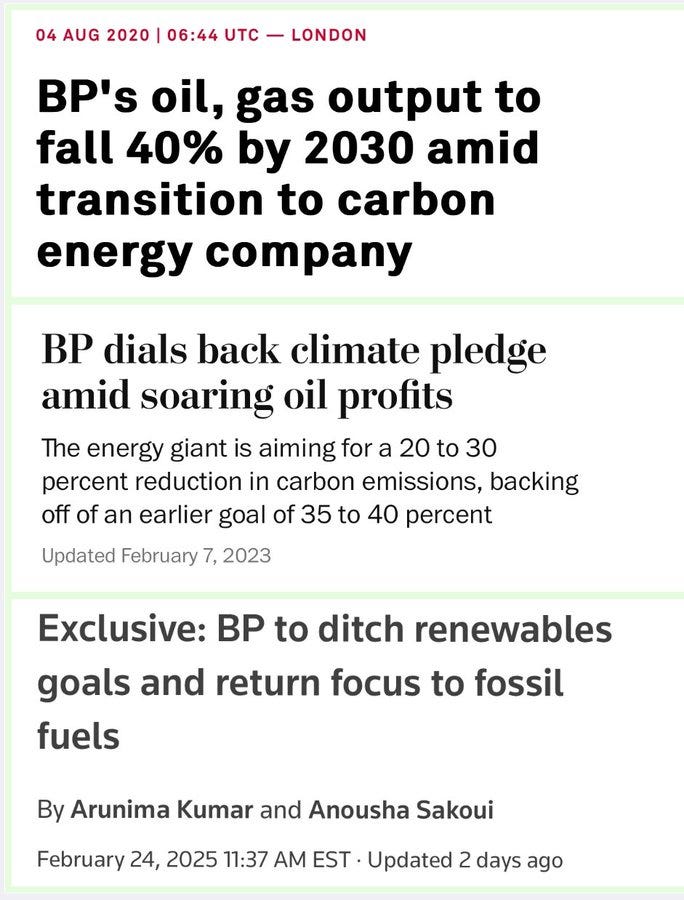

BP has made its position crystal clear, net zero is out, oil is back. It’s that drill baby drill mentality and it’s al about fossil fuels now. Green energy- thing of the past.

BP is all in on fossil fuels - but - 𝗗𝗼 𝗜 𝘁𝗵𝗶𝗻𝗸 𝗕𝗣 𝘄𝗶𝗹𝗹 𝗰𝘂𝘁 𝗺𝗼𝗿𝗲 𝗷𝗼𝗯𝘀? Yeah, I do. These kinds of cost-cutting moves rarely stop at one round. If I had to call it, I'm thinking summer time announcements? Q2/Q3.

The green energy transition they pushed, let’s be super honest: Investors didn’t buy into it, actually, literally. And BP’s leadership got the message. But great news- it’s over.

This flip flop back is a fundamental reset, but here’s the problem for their workers: resets don’t happen without casualties.

When a company destroys entire divisions, changes investment strategy, and starts funneling billions into one sector while pulling billions from another, jobs DISAPPEAR... And that’s exactly what we’re seeing at BP.

Let’s break down the hiring data, the workforce trends, and what this means for BP’s labor market position in 2025 and beyond.

Hiring Data Doesn’t Lie

BP cut 4,700 full-time employees and eliminated 3,000 contractor positions as part of its latest $2 billion cost-cutting initiative earlier this year. These were total structural eliminations tied directly to BP’s shift away from renewables and back into legacy fossil fuel production.

Want job security at BP? Make yourself essential to oil production. Anything else is dead weight.

Hiring peaked in 2021 and has been declining ever since. That’s not unusual, considering 2021 was a post-pandemic recovery year. But what’s notable is that BP never truly ramped up hiring again. Even as oil demand surged in 2022 and 2023, BP wasn’t growing its workforce.

Layoffs have outpaced hiring in business management, operations, and finance. These are not departments companies cut when they’re expanding—these are departments companies cut when they’re consolidating.

Engineering remains stable—but only just. BP still needs engineers to support drilling, production, and refining operations, but we’re not seeing massive expansion in hiring. It’s measured, targeted, and only where it’s absolutely necessary.

So yea, that’s interesting factoids and all… but what does this mean?

BP is not in growth mode. It’s in consolidation mode.

They’re not adding headcount to take on new markets. They’re realigning to maximize profit margins on existing assets.

BP’s 2025 hiring strategy in one sentence.

If your job doesn’t make them money, they don’t need you.

If you want to understand why BP’s workforce is shrinking, look no further than its latest investor strategy.

Elliott Management—a firm known for aggressive shareholder activism—just took a $5 billion stake in BP, making it the company’s third-largest shareholder. That happened right after the job cuts.

That’s not a coincidence.

BP is realigning itself with investor expectations:

$10 billion will now flow into oil and gas through 2027. The same core business BP was supposedly de-emphasizing.

Planned renewables investment has been cut by more than $5 billion. Whatever sustainability push they had is over.

BP is divesting non-core assets. Castrol and Lightsource BP are on the chopping block, meaning even more workforce reductions are coming.

Shell is making the same move. This isn’t just a BP problem—it’s an industry-wide shift. Investors wanted numbers, not net zero.

And that means BP’s workforce will continue shifting away from transition-focused roles.

So, will BP cut more jobs?

Yes. This isn’t over.

A second round of cost-cutting is likely in mid-2025. We’ve seen this playbook before. A company doesn’t make a deep cut and then immediately stabilize. There’s usually another wave a few months later.

Corporate roles are most at risk. The company has already deprioritized business operations, finance, and project management. If you’re in one of these functions, it’s time to start planning your next move.

Drilling and infrastructure hiring will continue—but selectively. BP isn’t eliminating oil production jobs, but they’re also not throwing open the floodgates on hiring. They’re playing defense, not offense.

If you think BP’s job cuts are over, you haven’t been paying attention. The second wave is coming, and it won’t be subtle. Look to Q2/Q3 2025 for this.

There’s also the matter of BP’s asset sales, and yes this is a major signal that the company is reducing headcount before divesting.

If Lightsource BP and Castrol are sold off, expect further workforce reductions. BP isn’t just downsizing in certain areas, it’s exiting them entirely.

IS BP STILL HIRING THOUGH?

If you’re looking at BP for a role in 2025, this is what you need to know.

PROS

Core oil and gas engineering roles will remain stable. BP still needs petroleum engineers, geologists, and drilling specialists to maintain production levels. Those jobs aren’t going away.

Infrastructure and drilling-related hiring will continue, but at a measured pace. BP will replace critical roles but isn’t likely to expand beyond necessity.

CONS

Corporate, finance, and operations roles are in decline. The numbers are clear: these jobs have been shrinking for years, and nothing suggests that will change.

Renewables hiring is functionally over at BP. If your expertise is in wind, solar, or alternative energy, this is not the company for you.

BP will hire where it absolutely must, but this is not an expansion phase. This is about maximizing profit per employee.

If you’re in oil and gas, there are still opportunities at BP—but only if you align with their immediate priorities. If you’re in corporate or transition-related roles, you should already be looking at exit options. And if you’re still banking on BP’s renewable energy strategy? That’s hilarious… That strategy no longer exists.

Fantastic article!